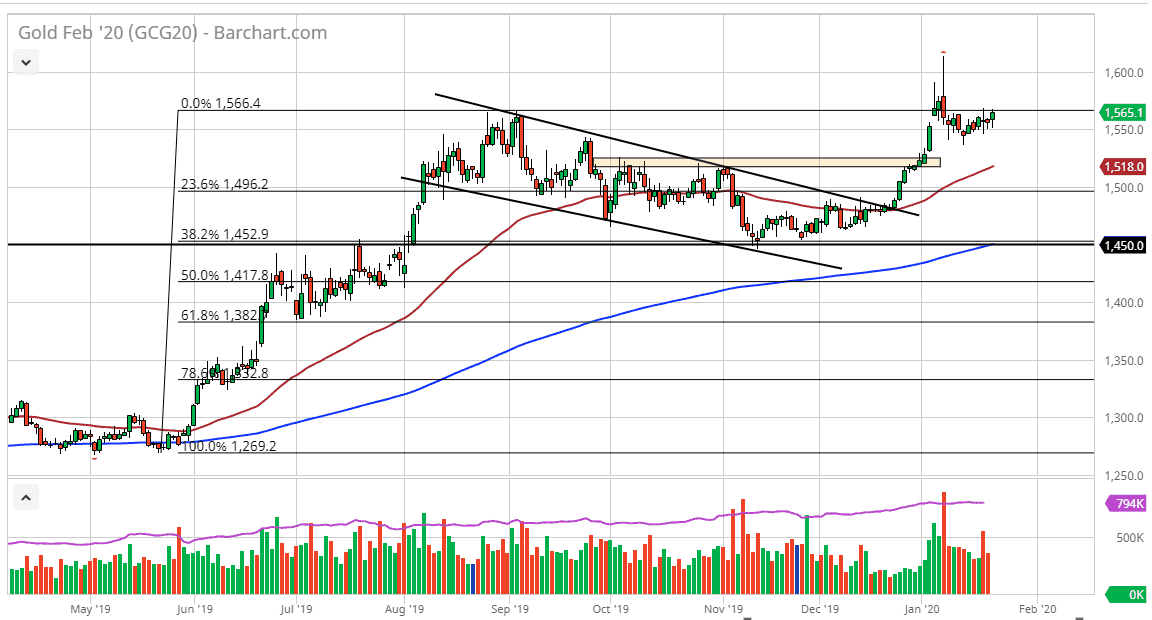

The gold markets have gone back and forth during the trading session on Thursday, as we continue to try to build up enough momentum to go higher. At this point, the $1550 level looks to be very supportive, just as the $1565 level seems to be rather resistant. With that being the case, it looks as if the market is a little bit confused at this point and is trying to figure out where to go next. That being said, we are in an uptrend, and it makes sense that we continue to do so.

If we do break out above the $1565 level, then I think the market goes looking towards the $1600 level. If we can break above there, it’s likely that the market is ready to go even further, based upon the bullish flag that we are starting to break out of, which measures for a move to the $1650 level. Furthermore, I believe that the longer-term target based upon longer-term charts of course is the $1800 level. Short-term pullbacks continue to offer value as far as I can see so pay attention to the US dollar. If the US dollar falls in value, that could help the gold market as well.

Furthermore, pay attention to geopolitical issues as there have been a whole host of them driving gold higher over the longer term. Quite frankly, considering that the 50 day EMA is starting to reach towards $1525 level and slanted to the upside, it’s likely that we will find buyers on dips based upon technical structure if nothing else. It’s not until we break down below the $1500 level that I would be concerned about the overall trend, but quite frankly the 200 day EMA will probably be in the neighborhood during that time as well, so even then I will have to consider it before putting any money to work in one direction or another. At this point, I’m very bullish of gold, but I also recognize that it will be very noisy. I have been building up a core position and little bits and pieces, hoping for a bigger move over the longer term. As central banks around the world keep their monetary policy very accommodative, it makes sense that gold continues to find buyers. Just during the day on Thursday, we have seen the ECB reiterated its desire to liquefy markets. The Federal Reserve of course has continued to add to their balance sheet.