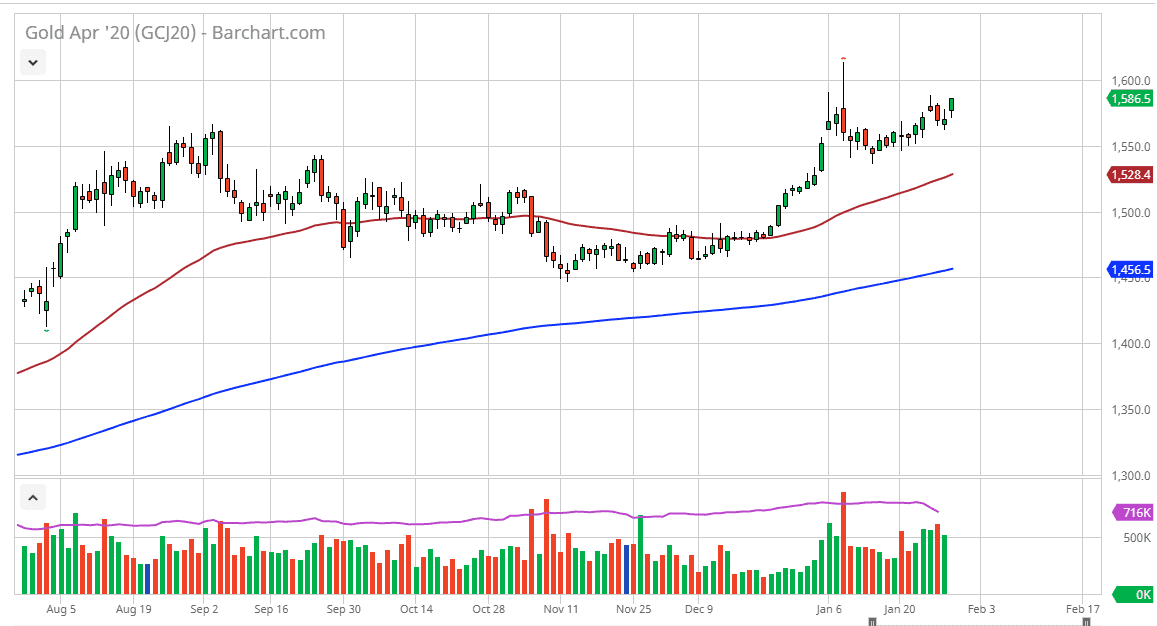

Gold markets have rallied again during the trading session on Thursday, initially gapping higher, but then pulled back to fill that gap before rallying yet again. Ultimately, this market looks as if it is going to go looking towards the $1600 level above, which was essentially the most recent high. If we can break above the $1600 level then it’s likely that the gold market will continue to go much higher than that, perhaps reaching towards the $1650 level. I like buying pullbacks going forward as gold has been so strong, and the Federal Reserve has since stated that the inflationary look is still murky at best, and therefore it means that the interest rates will continue to be very loose for a very long timeframe. That being the case, the market should continue to be favoring gold overall, as loose monetary policy has been reiterated recently from both Europe and the United States.

The $1550 level underneath should be massive support, as we had seen a nice hammer back at that level, and then turned around to rally from there. The 50 day EMA underneath is going to offer support if we do pull back from there. At that point in time, the market would probably offer a significant amount of value the people would be willing to take advantage of. Nonetheless, it looks very unlikely that the market will pull back that much. In the shorter-term, I believe it’s only a matter of time before the market breaks above the $1600 level, and then go looking towards the $1650 level in the short term. Longer-term analysis leads me to believe that this market will go looking towards the $1800 level but obviously that could take some time.

Furthermore, there are fears of coronavirus out there, so having said that people are worried about global growth. That being said, coronavirus is simply an excuse for the market to go higher. Central bank easing of rates and buying assets will continue to have gold rally in the face of a “race to the bottom” as far as interest rates and currencies are concerned. Ultimately, I believe that this market will find plenty of reasons to go higher over the longer term, so look for value and then take advantage of it as there is plenty of upward momentum going forward, and selling gold at this point is almost impossible.