The gold markets rallied a bit during the trading session on Wednesday, breaking above the top of the hammer from the Tuesday session. This is a bullish sign, and it is interesting that we are seen the gold markets rally a bit on the same day that we have seen the Americans and Chinese signing the so-called “Phase 1 deal” that has been in the headlines. Ultimately, this may be the market looking at the situation as one that is a “sell the rally” type of deal, but what may be more likely is the fact that the US dollar will lose a little bit of strength in more of a “risk on” type of scenario. In other words, part of what is driving this market higher is probably FX related more than anything else.

The hammer from the Tuesday session was of course very important, so having said that I think that the market is likely to continue seeing an upward proclivity anyway, due to the fact that we have been in a nice uptrend. The massive shooting star from last week was a bit of a relief rally as things calmed down between the Americans and the Iranians. Nonetheless, the market had been rallying long before that as well, so at this point it makes quite a bit of sense that the overall uptrend should continue.

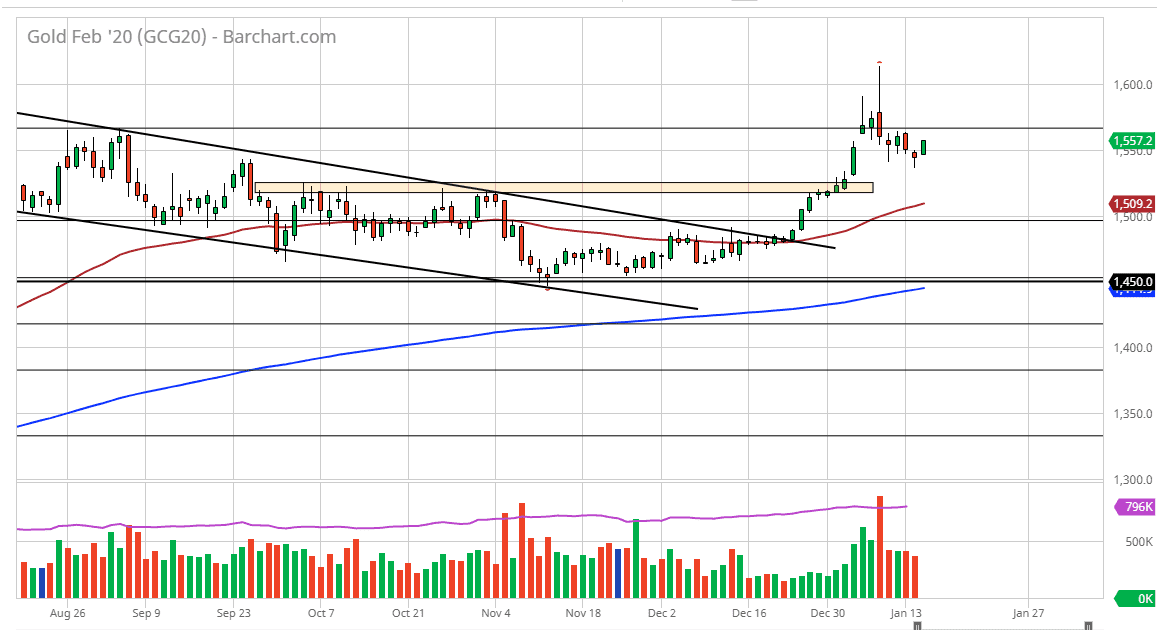

To the downside, I see the 50 day EMA underneath as offering support just above the $1500 level, which of course is a psychologically significant level as well. I also see a certain amount of support in the form of the $1525 level, so at this point I have no interest in shorting this market. Rather than doing that, I would like to buy this market on short-term pullbacks, as it could offer a bit of value. I think that the market is still trying to build up enough momentum to continue to go higher, showing signs that we are perhaps building up a bit of a base to the upside, as the market continues to grind back and forth but with more of an upward momentum. If we can clear the $1600 level, it’s very likely that this market will then continue to go much higher, perhaps reaching towards the $1800 level based upon longer-term analysis. Alternately, if we were to break down below the $1450 level, something that would take quite a bit of bearish momentum, then I would become a seller.