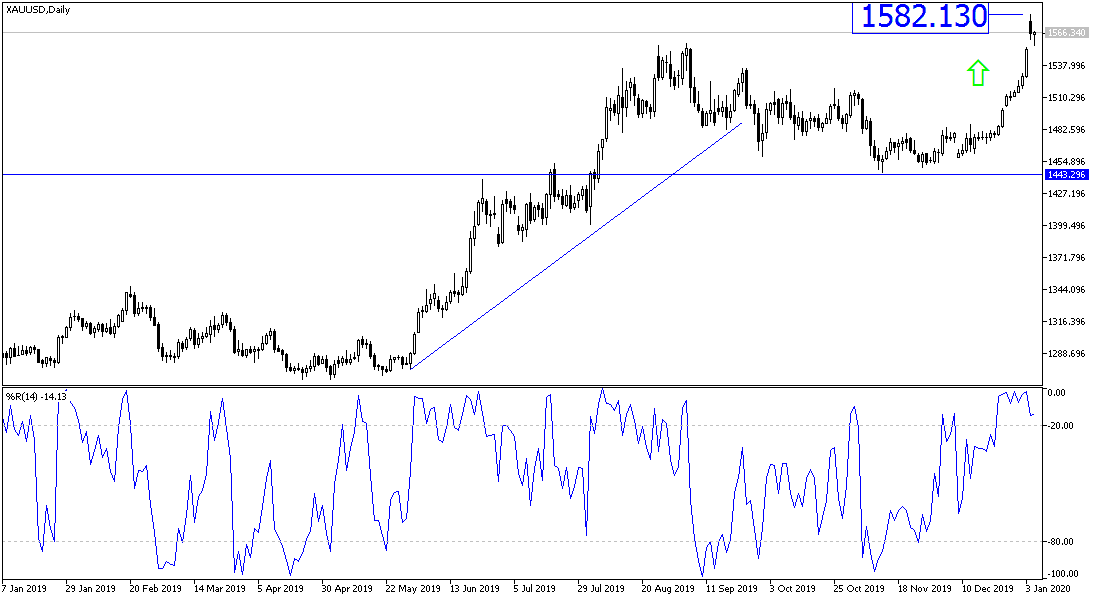

The price of gold has risen by more than $40 since the killing of Qassem Soleimani. Historically, it performed well in times of military conflict, such as the two wars in the Persian Gulf and the attacks of September 11, 2001, ignoring global interest rates and movements of the US dollar. The price of gold has jumped to the $1582 level, the highest for more than six years, and with a wait-and-see mode, the price has fallen to the $1555 level in early trading today before settling around $1566 at the time of writing. The clash between the United States and Iran, and the details of the expected trade agreement between the United States and China will be the most influencing factors on gold price movements in the coming period.

The US dollar will react this week to the announcement of the details of the important US jobs report. Strong job growth has helped support the American economy, even with the trade wars that have hurt manufacturing worldwide. Economists expect a report on Friday to show employers added 155,000 jobs last month. One of the reasons why the S&P 500 rose to its second best performance in 22 years in 2019 is the strong labor market.

Safe haven demand remains a key driver for both currency and bond markets, and therefore gold, which is an ideal safe haven for investors in times of uncertainty, will benefit in the event of escalating tensions between Iran and the United States of America.

According to the technical analysis of gold today: the general trend of gold prices is still bullish, and stability above the $1500 psychological resistance supports this trend. Stabilizing prices above the $1575 resistance will support the move immediately, and break through the next psychological resistance at $1600. Without a return to stability below the $1500 level, there will be no bearish bounce for gold. It should be borne in mind that prices have reached saturated levels of purchase and calmed the current situation, and if it is excluded, it may support sales of profit-taking.

As for the economic calendar data: Gold will interact with the announcement of inflation figures from the Eurozone, then the US trade balance, the ISM purchasing managers' index for services sector, and US factory orders data will be announced.