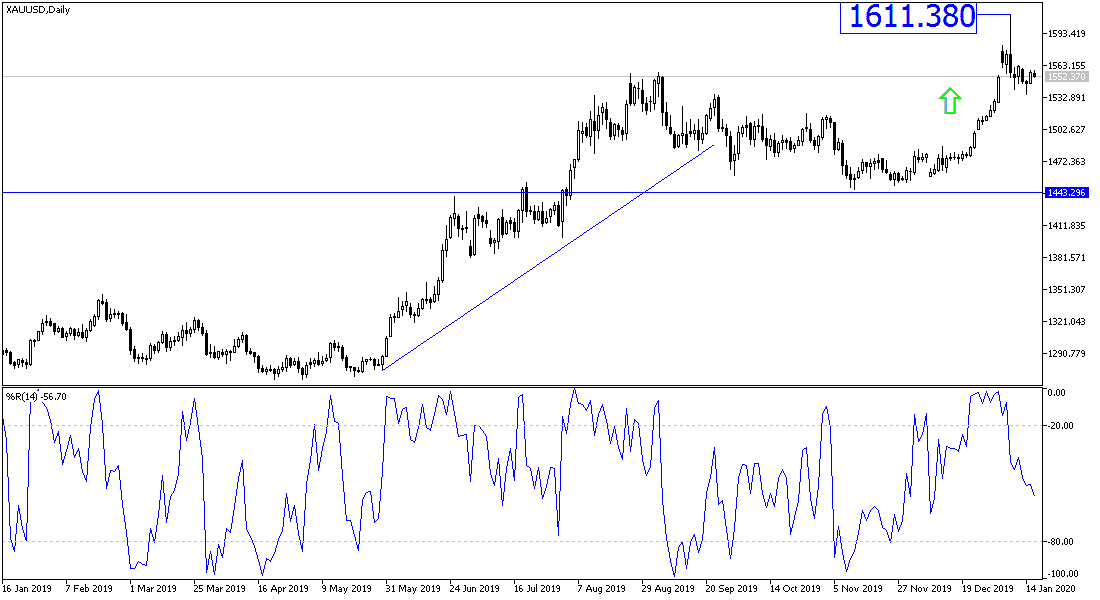

For six trading sessions in a row, gold prices are moving within a narrow range between the $1536 support and $1563 resistance, before settling around $1553 at the time of writing, awaiting any developments. There was no strong reaction to the yellow metal after the signing of the Phase 1 trade agreement between the United States and China yesterday, which halted the pace of the tariff war between them, which was the greatest threat to the global economy as a whole. Gold was not affected much by investors' recent increased risk appetite. The gold investors' adherence to the current levels may be due to the fact that markets are preparing for more global geopolitical tensions, as the situation in the Middle East region is still not completely calm. Yesterday, the US House of Representatives voted to form the committee that will hold President Trump accountable, and the approval was passed to the Senate.

Global central banks recent guidance to further ease their monetary policy will be in favor of gold gains as well.

The most prominent in yesterday’s long awaited deal was that the United States would stop imposing more tariffs on China's imports and deduct the amount of half on some of the already imposed tariffs, in addition to keeping some tariffs as a pressure card on Beijing to adhere to the terms of the last agreement. In return, China will increase its purchases of US products by 200 billion dollars over two years, including agricultural and other products. Also, China is to fight sites selling counterfeit goods, and ends the policy of imposing technology delivery from foreign companies as a price for entering the Chinese market.

The next stages will be important to the future of the deal, and after the signing, reports emerged that the second stage may arrive before or even after the presidential elections in the United States, scheduled for next November.

According to the technical analysis of gold: The general trend of gold prices is still bullish as long as it remains stable above the $1500 psychological resistance. But it must be taken into account that the stability of performance in a limited range for several sessions foreshadows a strong movement ahead and may soon be in one of two directions, depending on the extent of investors' appetite for risk, alongside the performance of the US dollar. Currently, the nearest gold resistance levels are at 1566, 1575 and 1600, respectively. On the downside, the closest support levels for gold are currently at 1538, 1527 and 1515, respectively, and the last level is ideal to start buying again.

Gold will react today with the release of the US retail sales figures and the Philadelphia Industrial Index. Also, there will be statements from the European Central Bank Governor Lagarde.