The yellow metal ignored the strength of the US dollar amid purchases that pushed the price of gold towards the $1561 level an ounce. Gold investors will watch the renewed global trade and geopolitical tensions to push gold prices to achieve more gains. Gold prices have shown no concern for the calm tensions between the United States of America and Iran, nor for the formal signing of the Phase 1 trade agreement between the United States and China.

Gold will be watching the results of four central bank meetings this week. The most prominent will be the Japanese Central Bank meeting, where it is expected that the bank will remain at a negative rate around -0.10% unchanged. The Japanese yen fell to its lowest in more than six months, which may help the financial support provided by Prime Minister Abe (about 122 billion dollars) in preparation for the Olympic Games amd Bank of Japan's efforts to support the economy. The Japanese central bank will provide an update on the economic outlook. In October, it expected 0.7% growth in the 2020 financial year, and 1.0% in the 2021 financial year. The core inflation rate, which excludes fresh food prices, was expected to rise by 1.1% in 2020 and 1.5% in 2021. The outlook appears optimistic.

But a Bloomberg Economist survey found that the average forecast for 2020 growth was 0.5% and 0.7% in 2021. Japan has not announced its core CPI above 1% since April 2015. The tax increase will have the biggest impact on the new forecast.

After the Bank of Japan, the Canadian Central Bank will announce its monetary policy and stronger expectations that the bank will maintain its monetary policy unchanged, especially after the US administration approved a free trade agreement with Mexico and Canada and stopped the tariff war with China. We will be on a date with the second meeting of the European Central Bank under the leadership of Christine Lagarde. Investors are waiting for signals from Lagarde about updating the bank’s policy and providing the best, and has the review that he referred to in the previous meeting been completed. The Euro is still weak and the economic performance of the Eurozone does not predict an improvement soon, and the bank must intervene to revive the bloc economy.

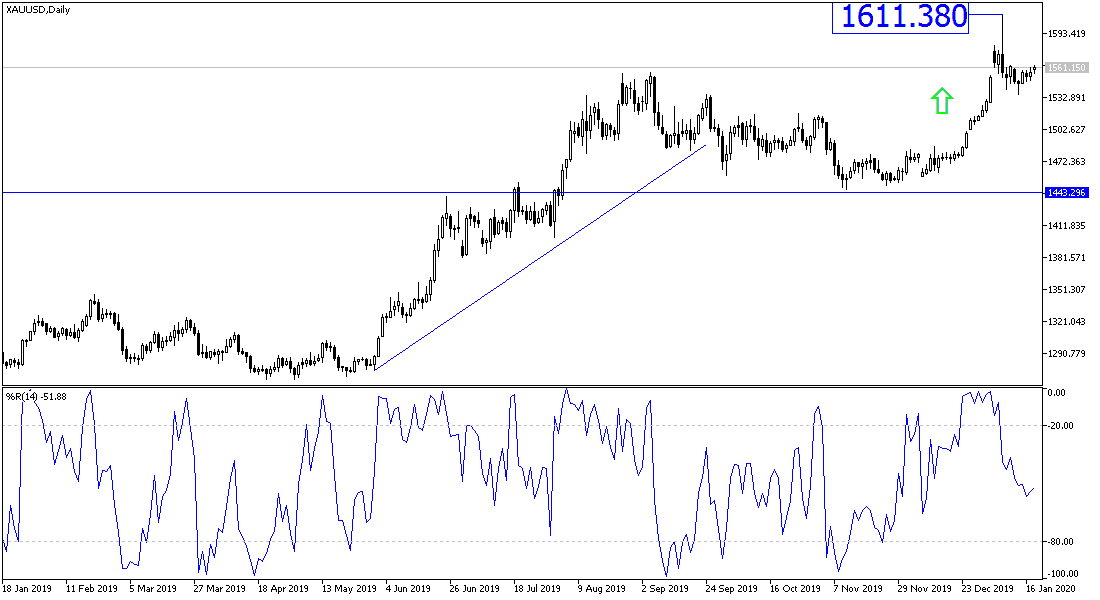

According to the technical analysis of gold: There is no change in my technical view of Gold prices. On the downside, the closest support levels for gold are currently at 1549, 1538 and 1525 dollars, respectively, and I still prefer to buy gold from each downside level. The US market is on holiday, and the lack of important economic releases today may support a limited and small-scale movement of gold prices.