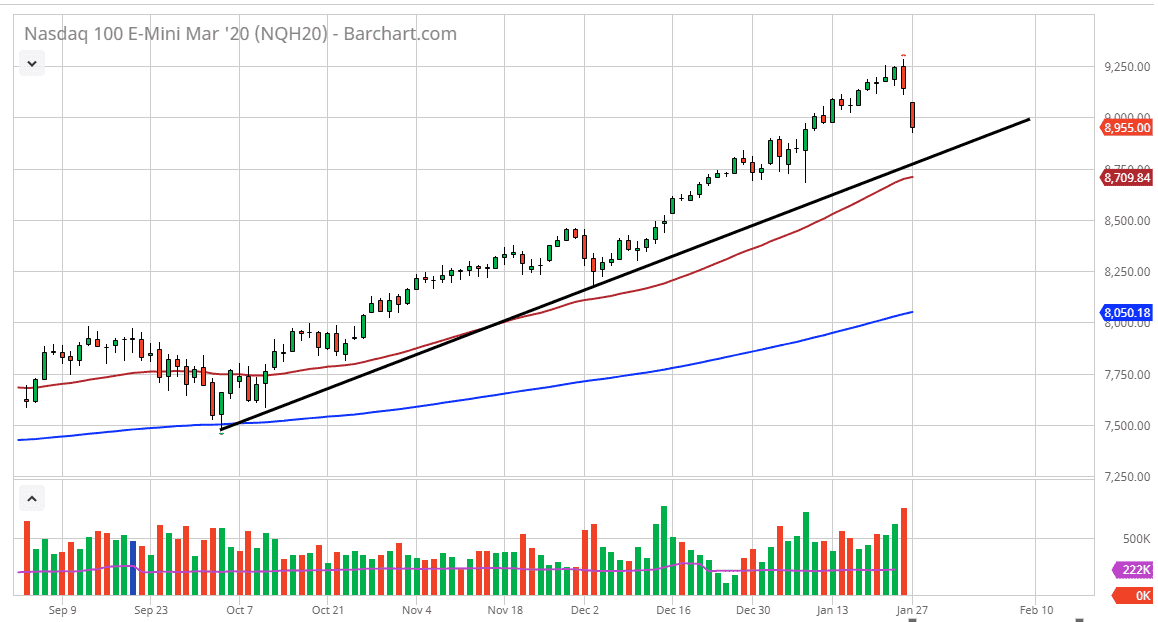

The NASDAQ 100 has fallen rather hard during the trading session on Monday, as we continue to see a lot of concerned traders around the world. The gap has not been filled, and quite frankly it looks like we are going to go down towards the trendline that I have marked on the chart. This means we could go as low as 8700, but a lot of this is going to come down as to how Asia works out. The Chinese indices of course will be worth watching, but with the Chinese New Year going on it’s very unlikely that we will see a complete true measure as to what’s going on in China, but clearly there are a lot of concerns when it comes to the coronavirus and therefore there is a general “risk off” type of situation around the world. That being said, the NASDAQ 100 could continue to see extended negativity due to the fact that the major companies in this index tend to do a lot of business in both countries.

The trendline of course will attract a lot of attention, just as the 50 day EMA well. Ultimately, this is a market that I think will continue to see a lot of volatility and quite frankly we needed this pullback. The coronavirus is simply an excuse for the pullback, and it looks like the market is trying to fulfill the need for some type of pullback. The market can’t go straight up forever, and it had been a bit overextended, so having said that it makes sense that we get this reaction.

If we were to break down below the uptrend line in the 50 day EMA, the NASDAQ 100 could break down rather significantly. The 8500 level is an area that I think would attract a lot of attention due to the fact that it was previous resistance, and then of course the 50 day EMA. Nonetheless, I am looking for an opportunity to buy some type of bounce off of the trendline, as well as the 50 day EMA. That being said, I’m going to wait until we get some type of daily close to make a decision as to whether or not I am putting money to work. I will keep you up-to-date as to what I’m doing here at Daily Forex going forward, so stay tuned as the daily candlestick will be what I make my decision based upon.