The NASDAQ 100 rallied significantly during the trading session on Tuesday, and even went as high as to fill the gap from the Monday open. At this point, I think we will see more of a grind back and forth as we wait for the FOMC Statement late during the Wednesday session. Ultimately, it will come down to what the Federal Reserve is going to do, as the stock market has been moving mainly due to loose monetary policy. At this point, the Federal Reserve keeping its monetary policy loose has been the biggest reason for stocks to go higher as there isn’t enough in the way of interest when it comes to bonds and other assets, so money continues to flow into the stock market because “there is no alternative.”

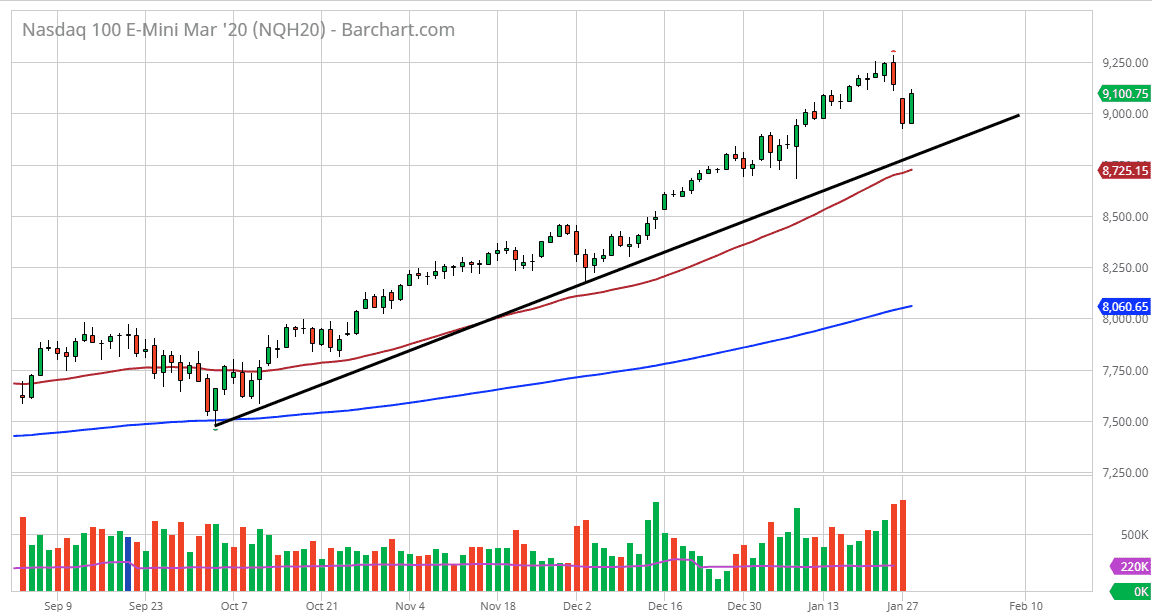

The market has broken above the 9000 level, and that’s a good sign, and quite frankly I was a bit surprised that we didn’t drop down towards the trendline as the market had been a bit overbought and there was an extraordinarily negative move. There is also the 50 day EMA that sits just below the uptrend line as well that should come into play also. All things being equal, this is a market that is highly sensitive to the Chinese situation, because so many of the companies that are on this index do quite a bit of business in both the United States and China.

The candlestick looks very healthy, and therefore it’s likely that we should continue to grind towards the 9250 level. This will be especially true if the FOMC gives the market the continuation of the “sugar high” that it has been on for over a decade. However, if the FOMC doesn’t do anything to loosen monetary policy or perhaps even suggest that they are even considering it, it’s possible that the market will go looking towards the trendline finally. Ultimately, this is a market that is bullish, so I don’t have any interest in trying to short the market unless something fundamentally changes, and quite frankly I don’t see that happening anytime soon. With that in mind, I’m looking for an opportunity to take advantage of value, and of course take advantage of a breakout. Short-term trading does offer opportunities to get involved as well, and at this point it has the same type of attitude: “buying on the dips.”