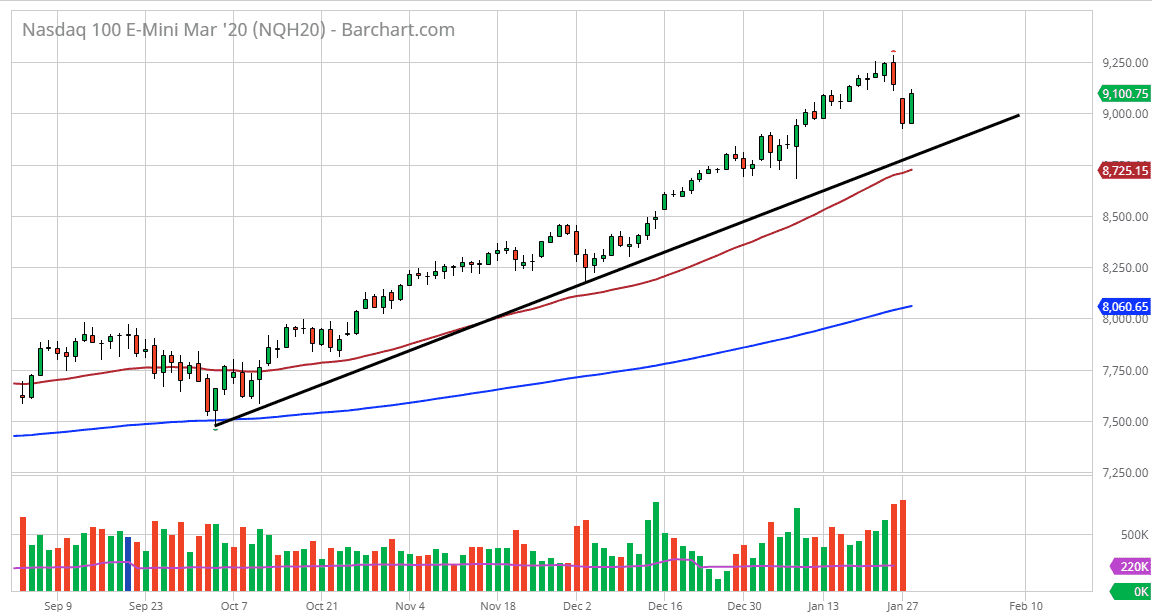

The NASDAQ 100 has filled the gap from earlier in the week, and now looks ripe to pull back slightly. Having said that, I don’t necessarily think that this is going to be a major breakdown, and therefore any pullback at this point will probably attract a certain amount of value hunters. Keep in mind that the uptrend line underneath is the inner uptrend line, so even if we do break down below there it’s likely that the market will continue to find buyers underneath at the 50 day EMA which coincides nicely with an uptrend line that is the main uptrend line. In other words, there are far too many reasons underneath to think that we will bounce, and then on top of that the 9000 level will of course bring buyers and as well.

If we can break above the top of the candlestick for the trading session on Wednesday, then the market is likely to go heading towards the all-time highs. With this, I think that it’s only a matter of time before we break above there, but it is massive bullish pressure that I see from the longer-term and even though we have seen quite a bit of a pullback as of late, most of this will be nothing but a bad memory once we get the coronavirus under control. Markets are looking for reason to sell off, and it looks like they found it. I don’t think that it gets out of hand though.

If we do break down below the 50 day EMA, then it’s likely that we could test the 8500 level, and then of course the 200 day EMA comes into play as well. That being said, I don’t think that happens anytime soon but if it does it would be a nice correction that value hunters can take advantage of for a longer-term investing. I think that it would take some type of shock to the system to make that happen, but there are plenty of things out there that could come into play. Nonetheless, the proclivity of Wall Street is to continue to buy on dips and that is my base case scenario going forward. At this point, bounces will continue to attract a lot of money based upon value in the fact that it is the overall trend anyway. The Federal Reserve was somewhat vague but looks to stay on the sidelines for the foreseeable future.