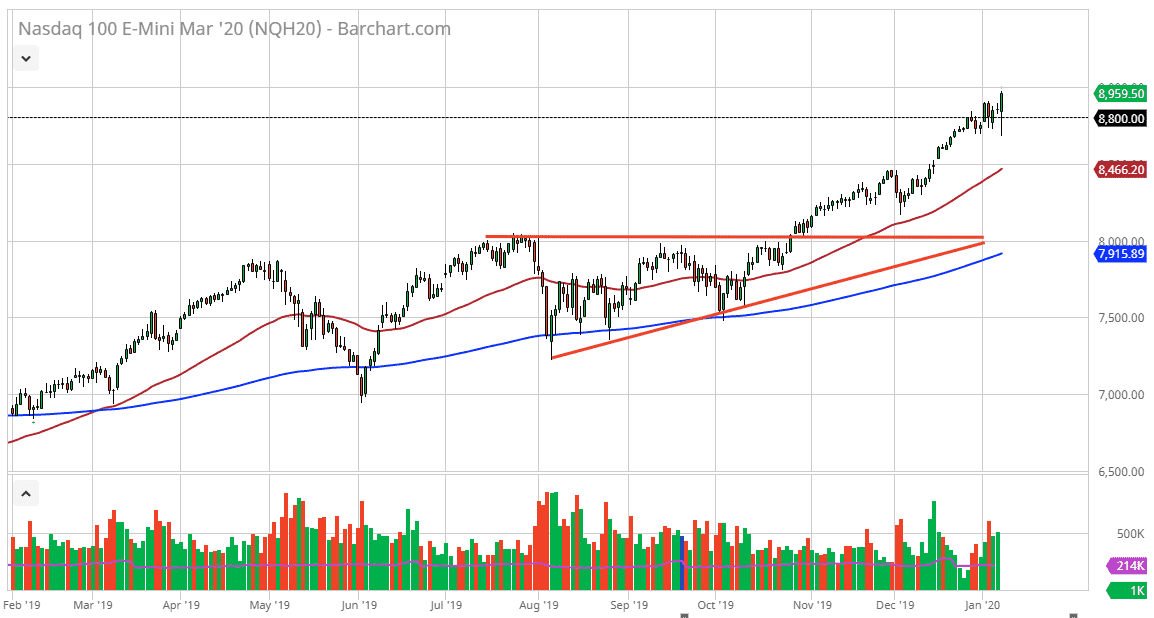

The NASDAQ 100 has initially gotten hammered during the trading session on Wednesday but turned around to show signs of strength as we continue to see the overall uptrend take over. This was initially a reaction overnight in the electronic markets as the Iranians set a dozen missiles towards US troops. However, it is obvious that they were aiming for the actual troops themselves, and therefore urges use that as an opportunity to “save face.” That being the case, the market is likely to continue going higher, considering that the trend has been strong for quite some time and at this point it shows no signs of abating.

Pullbacks at this point should continue to offer buying opportunities, as both the Iranians in the Americans look ready to stand down when it comes to the escalating tensions, and that of course is good for the markets. Furthermore, the ADP numbers came out better than anticipated during the trading session on Wednesday, so we started to see buyers jump into the market at that point as well. Ultimately, this is a market that should continue to see strength and I think will take on the 9000 handle. If we can break above the 9000 handle, then it’s likely that we continue to go higher.

Keep in mind that the $9000 level is a bit of a psychologically important figure, but at this point it’s obvious that selling is all but impossible. Any pullback at this point will end up being thought of as value, and the 50 day EMA currently trading around the 8500 level should offer plenty of support as well, so therefore I believe it’s only a matter of time before the buyers would get involved in that area based upon technical analysis as well, considering that the area had been previously resistive, so it should now be supported based upon “market memory.” If we were to break down through that area, then we would probably need to take a moment or two to figure things out but all things being equal it’s likely that we won’t even get down there. The 9000 level will course offer a bit of resistance, but eventually we will break through there and continue to go towards the 10,000 level based upon the momentum that we have seen for quite some time. Expect choppiness but with an upward tilt in general.