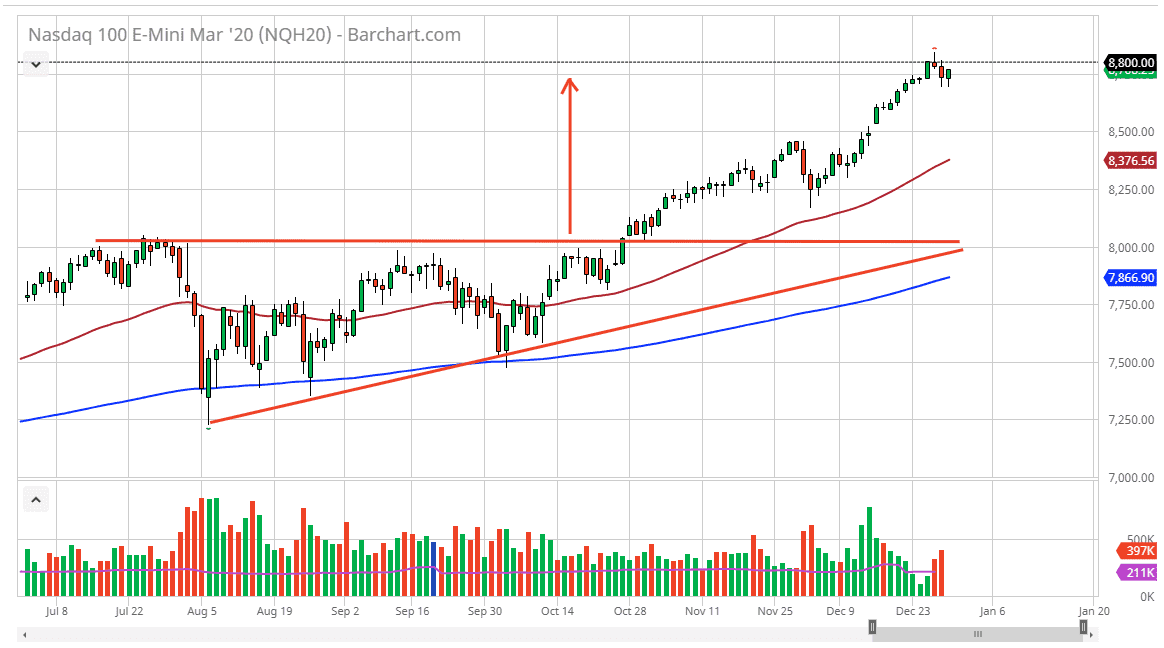

The NASDAQ 100 initially pulled back during the trading session on Tuesday but turned around to show signs of support yet again as we have so much in the way of bullish pressure longer term. At this point, it should also be noted that Donald Trump announced that the United States and China were getting ready to sign a trade agreement, at least the “phase 1” part of it. Ultimately, this is good for the stock markets in general, but this will be especially true in the NASDAQ 100 as it is fueled by so many technologically important companies. Because of this, it makes quite a bit of sense that the Chinese situation is a huge driver.

To the downside, I think that the $8500 level is an area that should offer plenty of support and I would love to buy down at that area. Any sign of a bounce in that area would be a nice buying opportunity, and it looks as if the 50 day EMA is probably going to come into play down at that level, so given enough time it’s likely that we would get a bounce from a technical standpoint if nothing else. That being said, the market is likely to offer opportunities if we do get a pull back, because quite frankly we are overextended. If we can break above the shooting star from the Friday session of last week though, that would be an extraordinarily bullish sign, and therefore would probably bring traders back in. That being the case, I believe that the market is one that you should be looking for value in, which is something that I can say on it almost daily basis as we are in such a strong uptrend and should look at pullbacks as buying opportunities. To the upside, the 9000 handle will probably offer a bit of resistance as it is a large, round, psychologically significant figure. That being said though, we could slice right through there. I think that this quarter is going to be very bullish for stock markets I will continue to buy on dips but I would probably build more of a core position at this point, not trying to jump in the market all at once, as it could cause quite a bit of volatility to your profit and loss statement. Nonetheless, I believe that the market will offer plenty of opportunities going forward.