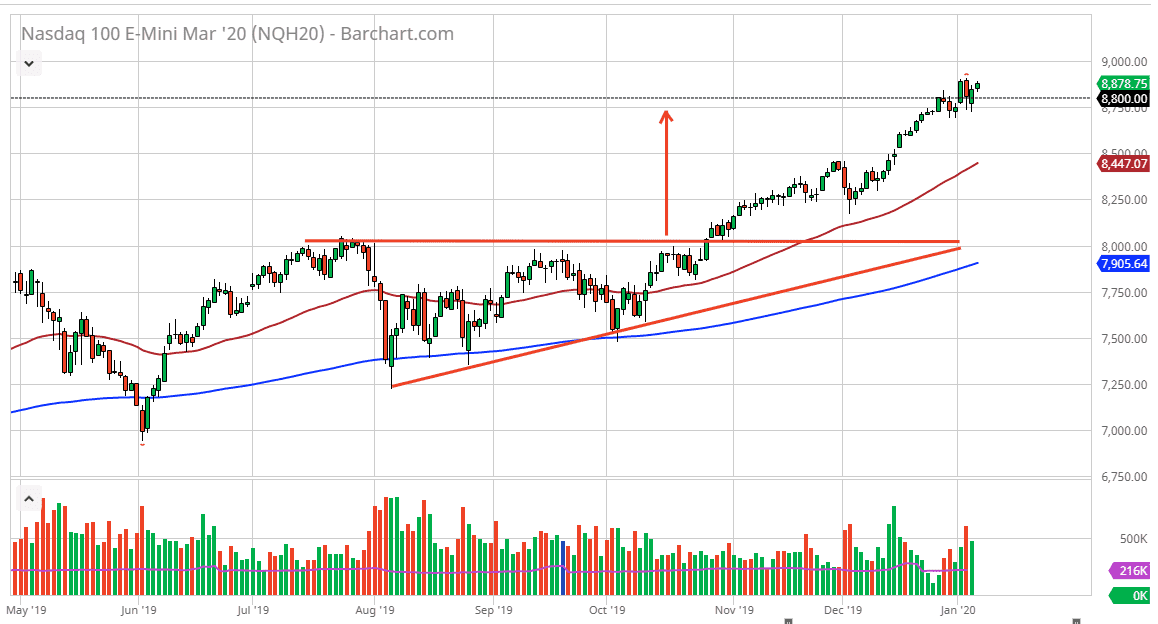

The NASDAQ 100 is very likely to continue turning back and forth during the week, as we get the jobs figure in the United States at the beginning of Friday in DC. At this point, the market is very likely to continue to find buyers on dips, but I think there are far too many questions out there to have the market break to the upside significantly. I think in the meantime it’s very likely that we see a lot of choppiness, and therefore noisy trading. Ultimately, the 9000 level above is the next target but if we can break through there it opens up a major move higher.

If we get some type of negativity or extraordinarily negative headline, then we could break down below the 8750 level, kicking off a move down to the 8500 level. That is where the 50 day EMA is coming to now, and therefore that will also be a supportive factor. Furthermore, it was where the previous resistance had been so a certain amount of “market memory” should come into play down there. That being said, the NASDAQ 100 is very sensitive to the US/China situation so keep that in mind, as headlines may or may not be coming out of that situation. The Chinese have suggested that they may not buy as much in the way of grains as once thought, so if that has an effect on the China trade deal, that of course will be negative for the stocks.

If we do break down below the 50 day EMA I think there are still places underneath where the buyers will probably get involved. I believe that it is only a matter of time before value hunters will come back in, just as I think that it’s only a matter of time before we finally break above the 9000 handle. The Federal Reserve will do everything you can to keep the markets propped up, and that is something that a lot of traders out there continue to bet on. The NASDAQ 100 will probably outperform as far as momentum is concerned when it comes to other US indices, and once we get past the 9000 handle longer-term traders will be looking at the crucial 9500 level. Shorting is impossible at this point, even though I fully recognize that we could drop 700 points. For me, that only offers value.