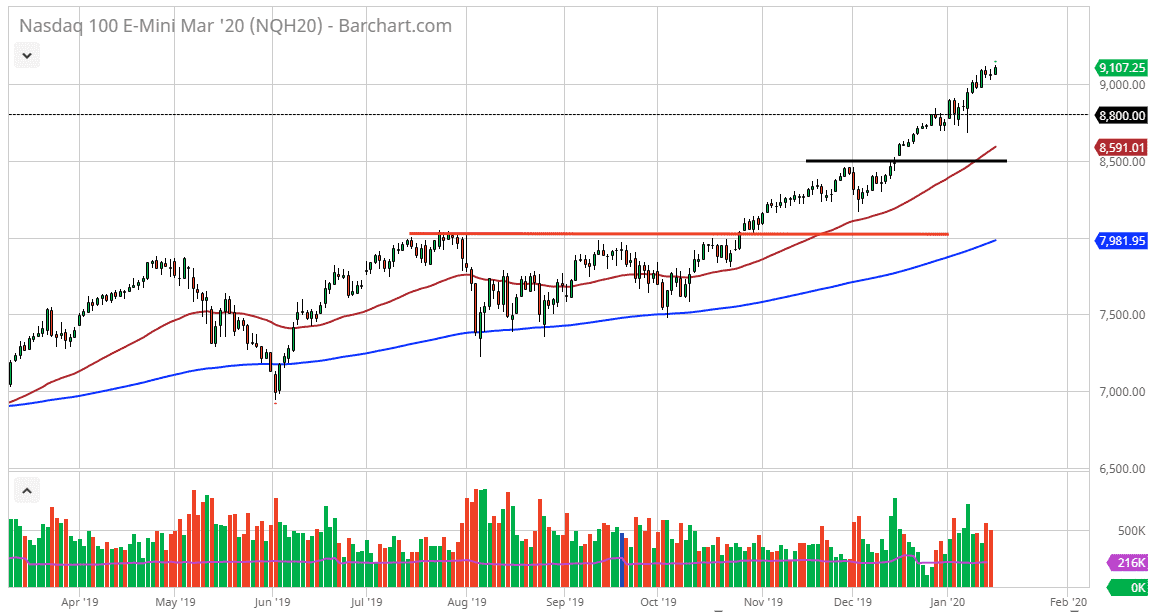

The NASDAQ 100 has rallied a bit during the trading session on Thursday, breaking above the 9100 level. That being the case, it makes sense that the market will continue to go higher longer term. The market has been strong for quite some time and it seems as if the 9000 level has hardly caused any reaction at all. The 50 day EMA is starting to reach to the upside, and therefore it looks as if the market will continue to see even further acceleration. At this point, the market is clearly in an uptrend and there’s no way to sell it. I think that the NASDAQ 100 has its eye on the 10,000 level sometime this year.

Looking at the 50 day EMA, it certainly looks as if it could go looking towards the 8800 level rather soon, an area that previously had been important due to the fact that it was a measured move from an ascending triangle. In fact, we have even pulled back to test that level and found plenty of buyers as we formed a massive hammer last week. The market looks very strong from there, and as it is the early part of the year, there will be a lot of money managers out there putting money to work.

Furthermore, the NASDAQ 100 is very sensitive to the US/China trade situation, as so many of the companies in this index do business in both places. With that being the case, it’s very likely that as long as the situation between the Americans and the Chinese can stay somewhat static or at least not get worse, the NASDAQ 100 has been given the “green light” to go higher. Don’t forget that there are a handful of companies that have a massive effect on this index, so pay attention to Apple, Tesla, eBay, and of course Amazon. This is essentially the “easy way to play all of these markets at the same time. They all look relatively strong, so I think that the market pulling back from here is going to be looked at as a nice buying opportunity. This isn’t to say that we are going to go straight up in the air but clearly you can’t short this market right now. Ultimately, there will be plenty of value hunters on these dips and I think that will continue to be the case for the time being.