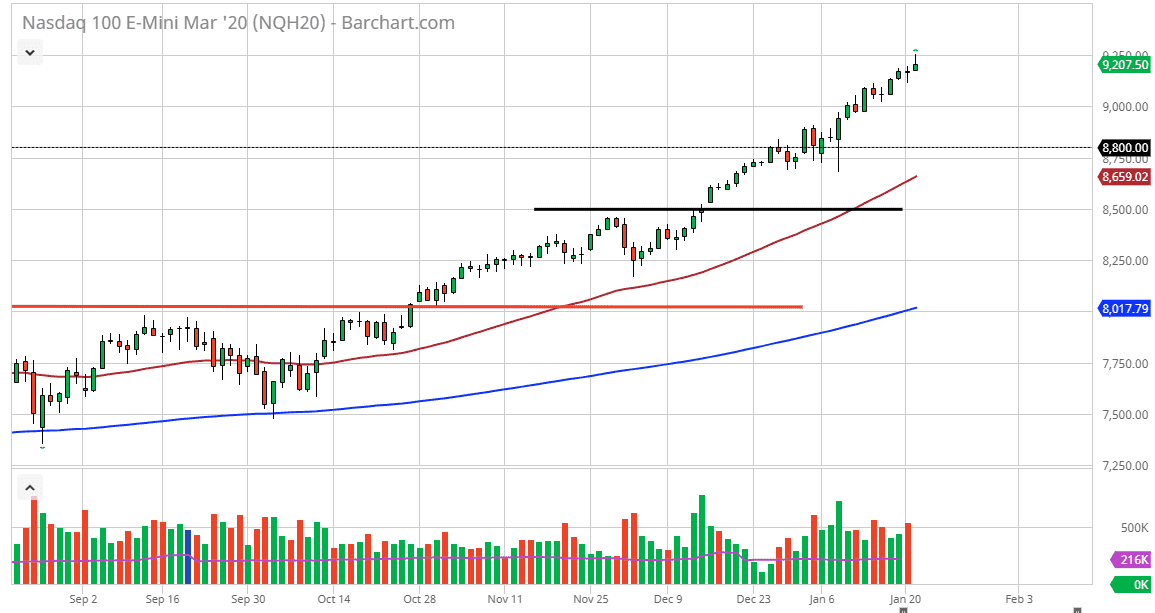

The NASDAQ 100 has initially shot higher during the trading session on Wednesday but gave back quite a bit of the gains as we reached the crucial 9250 handle. That obviously is an area that will attract a lot of attention due to the fact that it is somewhat of a round figure but pulling back the way we have only shows just how much we have in the way of exhaustion. At this point, I like the idea of picking up value every time it occurs, and I think that the overextension during the trading session on Wednesday will probably be but a distant memory as we are in the middle of earnings season.

Furthermore, the market is highly levered to the US/China trade situation, so as the US/China trade situation gets better, it’s likely that the NASDAQ 100 will go right along with it. That being said, expect a lot of volatility and at this point I would say you can almost bank on a pullback, but it's certainly not something that you can trade. That being the case, it’s very likely that you look at that as a buying opportunity. I don’t have any interest in trying to short this market, because the market is in a major uptrend and therefore it’s likely that we will eventually have an opportunity. A matter of being patient is probably the best way to describe this market.

There is the possibility that we break above the shooting star from the trading session on Wednesday, but that would probably be a bit too impulsive to get excited about. That could set up the possibility of a significant pullback, something that this market could probably use. In the meantime, though, the one thing you cannot do is fight what has been the case for so long.

I believe that the “floor” in the market begins at the 8800 level, right as the 50 day EMA is starting to race through that region. I like the idea of buying down there, but I don’t even know that we can get down there anytime soon. That being said, some type of shock to the system could make that happen but I wouldn’t hold my breath. Ultimately, I prefer to look at daily close is on this chart for opportunities to pick up value based upon bounces and supportive action in the NASDAQ 100.