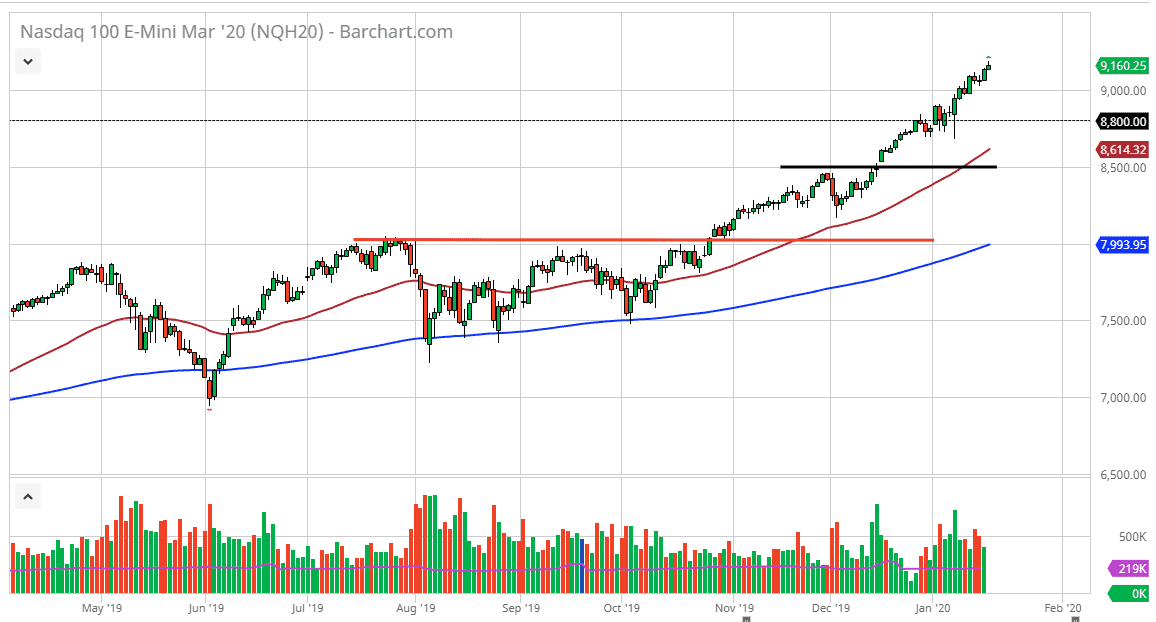

The NASDAQ 100 has rallied a bit during the trading session on Friday, as we continue to make fresh, new highs. At this point, the market does look a little bit stretched but it I believe that pullbacks will more than likely offer buying opportunities, with the 9000 level offering support. That being the case, I think it’s only a matter of time before the buyers get involved in and take advantage of the market being cheap.

The alternate scenario is that we simply break above the highs during the trading session on Friday, kicking the market off into more of an explosive move to the upside. At this point, the market is one that you can only by, you certainly can’t sell it as the US/China trade deal being signed helps the idea of these companies doing well, as they tend to do a lot of business with both markets. Because of this, this is a market that should eventually find an of value hundreds to come in and step up to start buying. The 9000 level obviously is a large, round, psychologically significant figure. Beyond that though, there is also the 50 day EMA underneath that should cause quite a bit of support as well.

In fact, it’s not until we break down below the 8500 level that I would be concerned, and furthermore it really is an until we break down below the 8000 level that the overall trend changes. That being said, we have gotten a bit ahead of ourselves, but I do think that this market will go looking towards 9500 level, perhaps even the 10,000 level by the end of the year. While that seems like a stretch to get there, you need to keep in mind that it would only be about a 10% gain for the year. All things being equal, I think it’s only a matter of time before we get an opportunity to pick up a bit of value, so paying attention to that is going to be crucial when trading the NASDAQ 100. I have no interest whatsoever in trying to short this market, at least not until we break down below the 200 day EMA which would be a massive disaster. Quite frankly, if that happens you will have seen some type of major shift in attitude and obviously the headlines out there would be screaming about the end of the world.