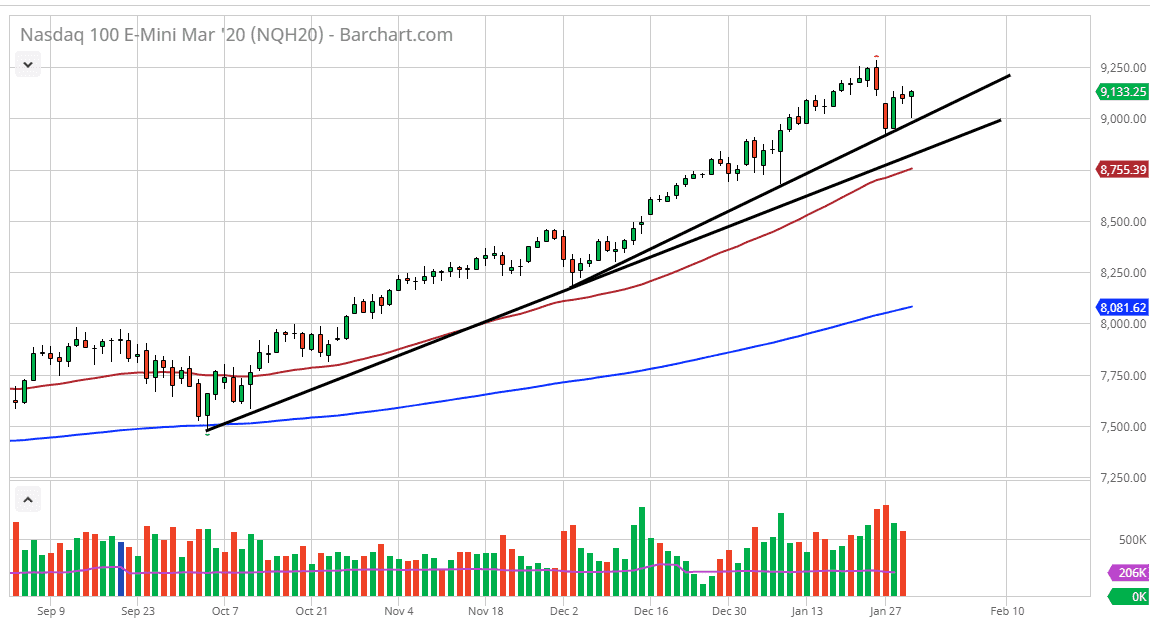

The NASDAQ 100 broke lower during the trading session, reaching towards the 9000 level, an area that I suggested that would be supportive, not only based upon the 9000 handle, but the fact that the enter uptrend line was underneath and ready to pick up buyers more than likely. We have turned around completely and gain 220 points from that low in the same session. It looks to me as if we are ready to break out to the upside, clearing to a fresh, new high. That doesn’t necessarily mean that has to happen today, but I think that the trading session during Thursday suggests that there are plenty of buyers underneath, so I look at pullbacks as opportunities to go long yet again.

Even if we break down below the 9000 level, it’s likely that we have plenty of support underneath at the lower trendline, and of course the 50 day EMA which is underneath. There is plenty of buying pressure underneath there, and I don’t think that there is any opportunity to sell this market, as we have seen so many buyers jump in on these dips. Most of the selling has been done by Asia and Europe, and not by the actual true volume in the United States. Keep in mind that Asia has to worry about an economic slowdown as far as the coronavirus is concerned, but once the United States takes over, that’s not a real concern for the locals.

Furthermore, more volume is coming out of Chicago than the Globex system, so you really can’t read too much into it. If we pull back going into the Asian and European sessions, do not be surprised at all to see traders jump back in during the trading session. Alternately, if we break out to fresh, new highs, then the market is going to continue to go to the 9500 level, and then eventually my longer-term target of 10,000 which I expect to see some time this year. With central banks, especially the Federal Reserve, looking likely to add liquidity to the system every time it is needed, it’s only a matter of time before stocks continue to climb. It’s been that way for the bulk of the time since the financial crisis, and nothing has changed from what I can see based upon statements coming out of the European Central Bank, the Federal Reserve, and the Bank of England.