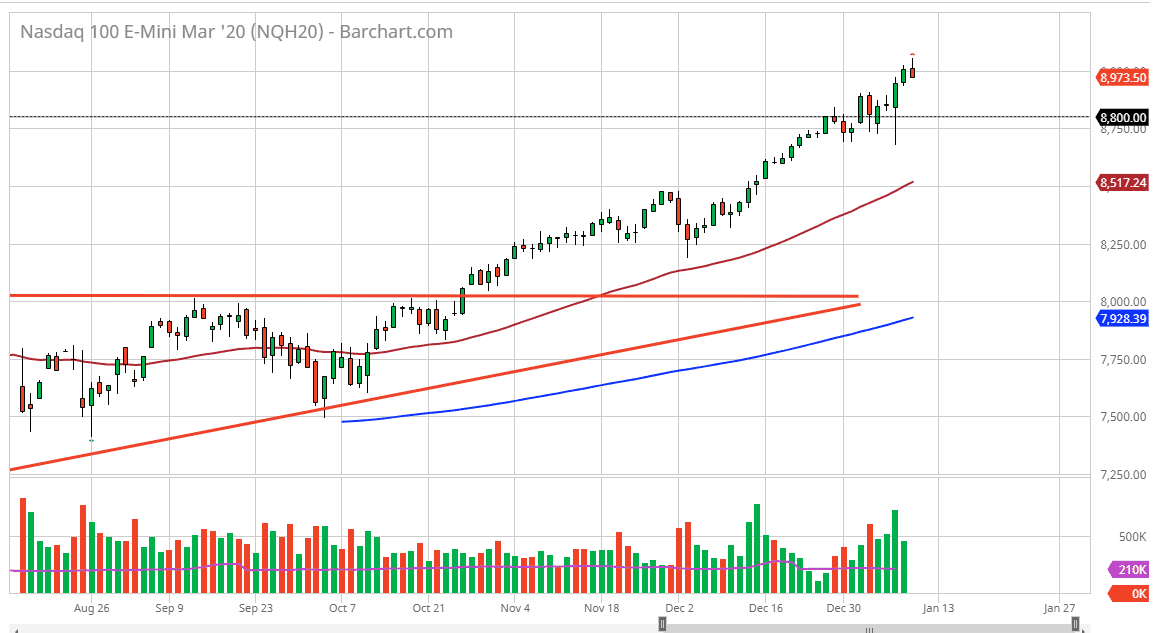

The NASDAQ 100 initially tried to rally during the day on Friday but pulled back a bit as we had broken above the 9000 handle. Obviously, there is a certain amount of psychological importance that the 9000 level, so it’s not a huge surprise to consider that the market may have taken a bit of profits. Furthermore, the jobs number missed the expected level, so that was another reason to start taking profits. However, you should keep in mind that most of the traders are still away and just coming to work on Monday, so I would only read so much into that. Furthermore, we are in an uptrend and had seen an exhaustive move from the bottom on Wednesday. Because of this, it makes sense that we will see a bit of value hunting underneath and I do think that the value will present itself rather quickly.

At this point, the 8800 level would be an excellent area to start buying if we can get down there and show signs of a bounce. The alternate scenario of course is that we simply break above the highs from the Friday session, and at that point I expect the market to get somewhat impulsive to the upside. However, it is most certainly going to be better placed for a trade to be put in after a bit of a pullback. Clearly it would be more palatable for traders as well, as you would be able to find plenty of value below. The 50 day EMA is breaking above the 8500 level so at this point I look at that as the “absolute floor” in the uptrend.

I believe that we will overtake the 9000 handle again, and then eventually go looking towards 9500. The NASDAQ 100 will continue to get a bit of a boost due to the fact that the Americans and the Chinese have settled down with the trade war, as most of the large companies in the NASDAQ 100 do a lot of business in both of those countries. With that, I believe that buying dips will continue to work and I think that most of the punditry out there feels the same as I do. I have no interest in shorting, at least not at this point unless of course something changes drastically from a fundamental standpoint. The Federal Reserve continues to liquefy markets as well.