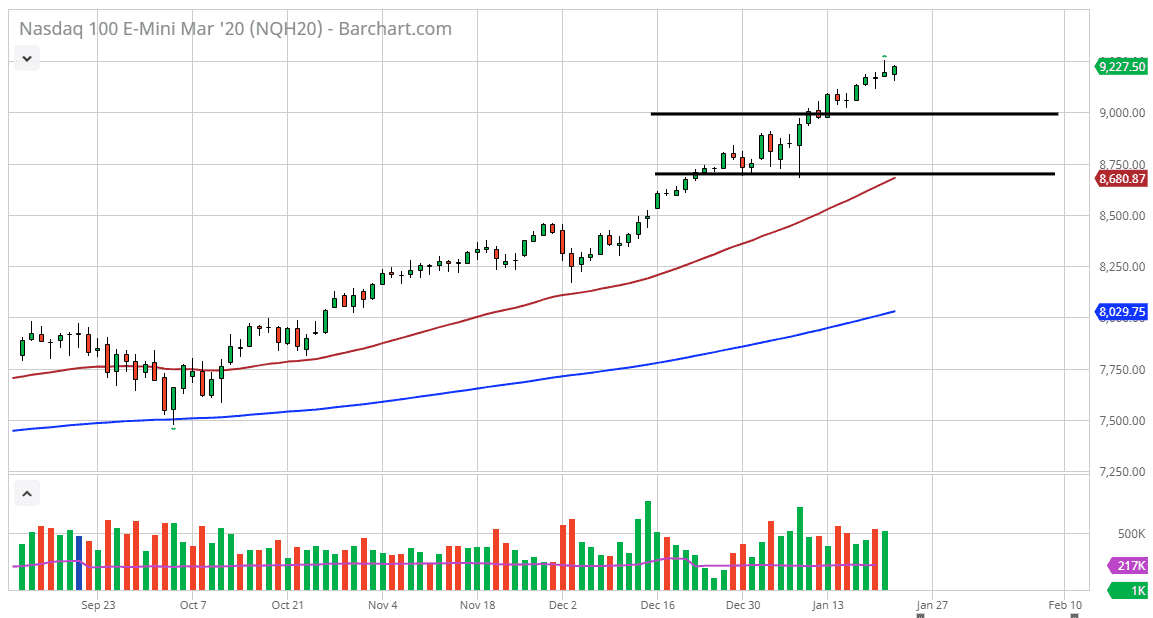

The NASDAQ 100 has initially pulled back during the trading session on Thursday, but then turned around to rally yet again. This is a market that seems like it can’t fall for any length of time. That being said, the idea of buying value is the best way forward, especially considering that the market has been so bullish for so long. The 9000 level underneath will of course offer a lot of interest as it is a large, round, psychologically significant figure, and it is also previous resistance. That being said, the market looks more likely to break out to the upside and make an all-time high than to do that. Ultimately, the 9250 level is simply another big figure that the market will try to break through. Once it does, the market is likely to go looking towards the 9500 level. Longer-term, I believe that the market goes as high as 10,000 above.

Even if we pull back below the 9000 handle, I also recognize that the 50 day EMA is currently testing support at the 8750 range, another area where I think the buyers will get involved. I like the idea of finding value but right now it doesn’t look as if this market is ready to pull back for any significant amount of time. What’s even more interesting is the fact that the Tuesday candlestick was a hammer which was followed by a shooting star. That typically means that the market is going to grind back and forth and try to form a short-term range. If we break out of that range, and other words breaking below the hammer or above the shooting star, then the next move is ready to happen.

All things being equal, even if we do break down below the hammer at this point, I have no interest in shorting this market because it is far too bullish longer term to try to fight the overall attitude of the NASDAQ 100. Stocks continue to get a boost from the Federal Reserve increasing its balance sheet and forcing traders to go into the stock markets as there is no other alternative right now. Yes, the market needs to pullback, but that doesn’t necessarily mean that it’s going to in the short term. Longer-term, it’s likely that we will see much higher prices, but sooner or later we need to pullback in order to find momentum.