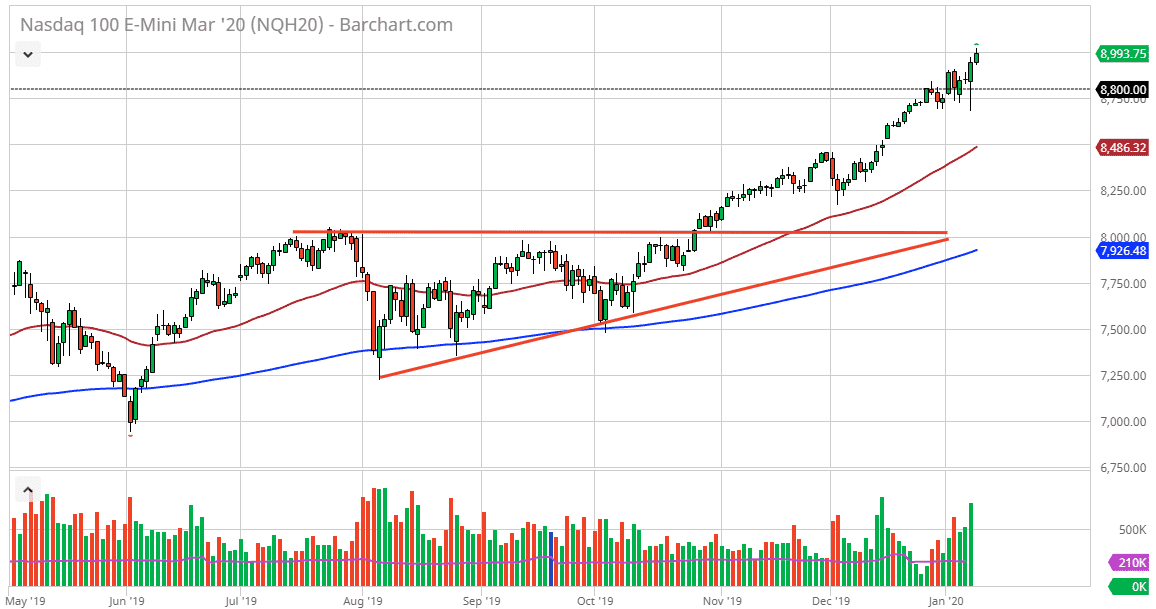

The NASDAQ 100 has rallied a bit during the trading session on Thursday, breaking above the 9000 level but pulling back a bit as the markets may have gotten a bit overextended. Beyond that, the market is also perhaps trying to cover ahead of the jobs number as it will cause a lot of volatility to say the least. Regardless, this is a market that is in an uptrend so it should be looked at through that prism. I hope that the market pulls back in a knee-jerk reaction to the jobs number so I can take advantage of the NASDAQ 100. The 8800 level should be a bit supportive, and I think it extends down to the 8700 level. The 9000 level of course has a certain amount of influence as well.

That being said, a pullback might actually be healthy. If we were to wipe out the bottom of the candlestick during the Wednesday session, the market will probably reach down towards the 50 day EMA which is closer to the 8500 level. That was a previous resistance barrier, and therefore it should offer support and what is thought of as “market memory.” I like the idea of picking up value if and when it shows up, as the stock markets are most clearly very bullish in general.

The alternate scenario is that we break the 9000 handle and continue to go much higher. That could send this market looking towards the 9500 level but ultimately, I think it is more of a “buy on the dips” type of situation and that is much more appealing due to the fact that it also offers value in what has so clearly been a strong uptrend. NASDAQ 100 companies typically are more sensitive to the US/China trade situation as well, so I do like the idea that this coming week we will see the Americans and the Chinese signing a “phase 1 deal”, thereby sending the main players in this index higher due to an easing of tensions. In fact, it’s not lesser some type of blowup between the Americans and the Chinese that I would be interested in shorting this market. The longer we go the more likely I am to pick up bits of value in this market. The 50 day EMA is certainly one to watch, although it is quite a bit of distance from here to there.