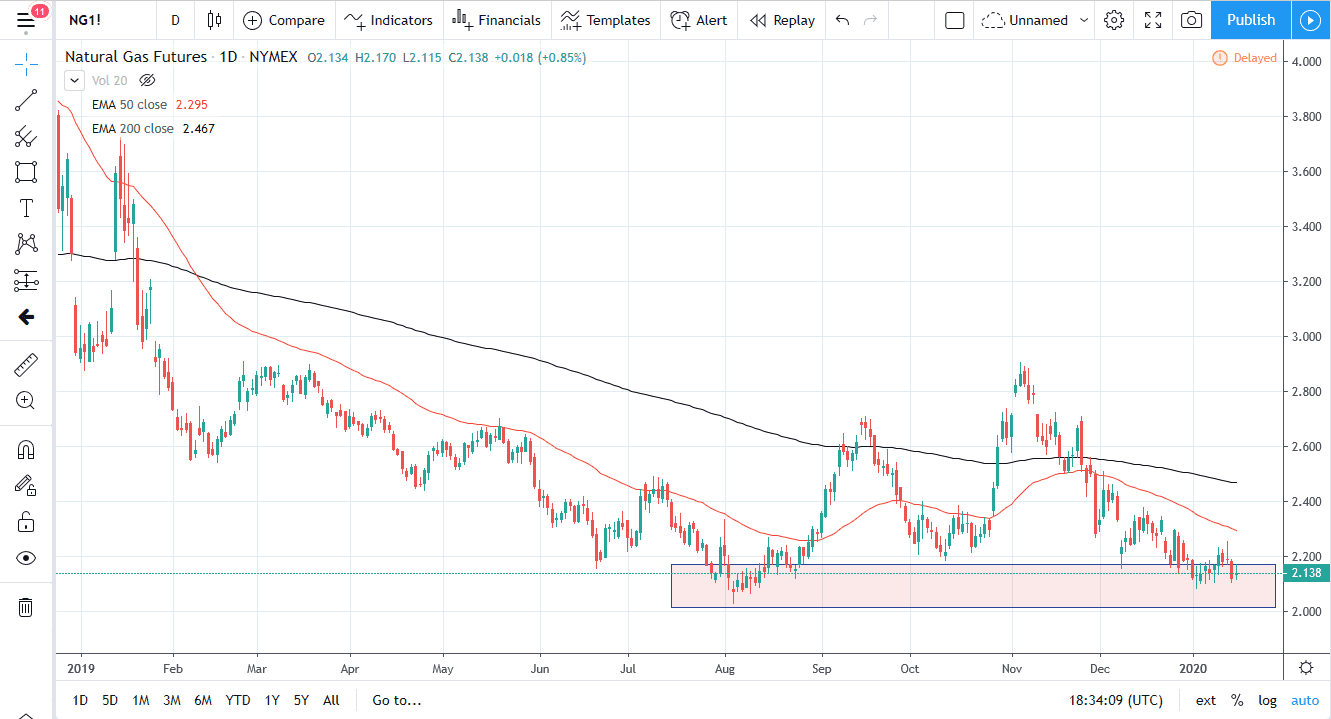

The Natural Gas markets formed a bit of a harami during the trading session on Thursday, as the Natural Gas Storage figures in the United States were much more bullish than anticipated. Coming in at -109 BCF, it was anticipated to be just -91 BCF, showing that there was more demand than anticipated. Having said that, the markets are still extremely oversupplied, and it is now getting to the point where some of the largest natural gas drillers in the United States are starting to see issues with their credit rating. The commodity is simply too cheap, but the problem is you can’t simply buy it because it’s fundamentally cheap, the market can stay down here for much longer than you think. If that’s going to be the case, then you need to keep in mind that the market will tell you what to do next.

There is a shooting star from the Tuesday session that needs to be broken to the upside to take any rally seriously. However, I believe that the market will continue to see a lot of negativity built in, because quite frankly it is so oversupplied when it comes to natural gas being stored. Furthermore, even if storage was chewed through, there is more than enough out there in the ground to go get.

Markets are completely out of balance at this point, and it’s only a matter of time before we start to see some of the oversupply come off. However, that’s probably a story for later in 2020, perhaps even 2021. Basically, the solution for higher natural gas prices longer-term is for some of these companies to go out of business.

At this point, we will probably get a spike in price sooner or later, but that price should be thought of as an opportunity to start selling again, and I would do so at the very first signs of exhaustion. This will be especially true near the 50 day EMA or the 200 day EMA, assuming we can even get there. What’s truly alarming for the natural gas markets is that we are halfway through January, and still can’t pick the market up off of a floor. Rally should be sold into, it’s basically the only trade that’s worked for any significant amount of time or significant amount of profits. With this, if we were to break down below the $2.00 level, that would be a complete disaster for this market.