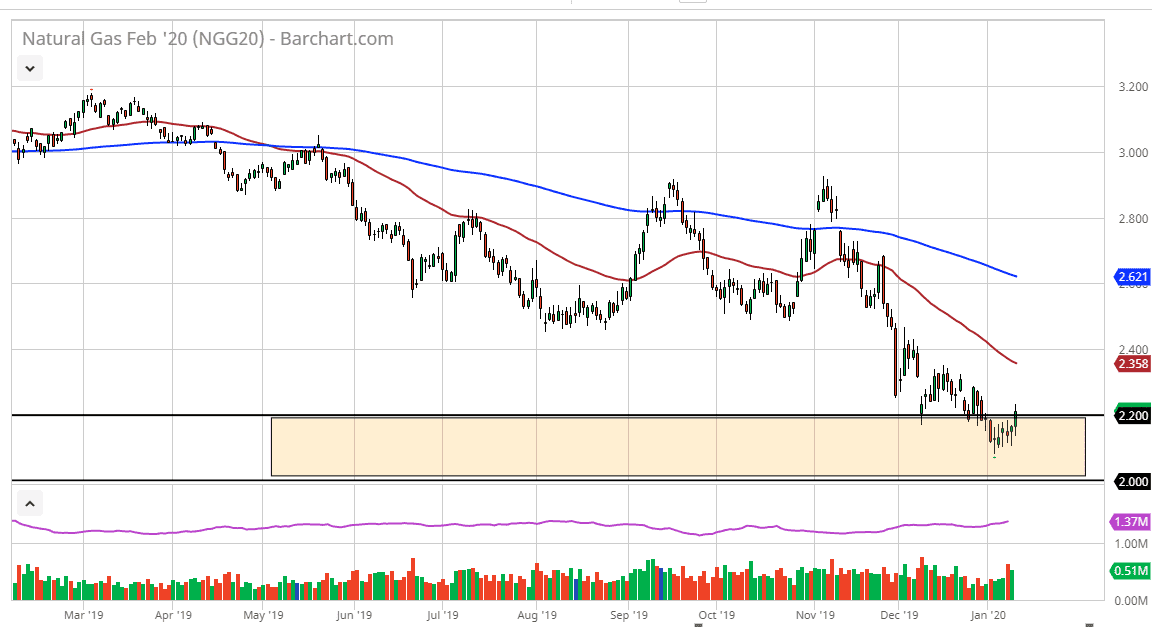

Natural gas markets initially pulled back during the trading session on Friday, but then rallied to break above the $2.20 level. This is an area that was psychologically important on both sides of the trade, as well as structurally important. Looking at the longer-term chart, it’s easy to see that the $2.00 level extend support all the way to the $2.20 level. The market is very beaten down at the moment, so it does make sense that we get a little bit of a “dead cat bounce.” All things being equal though, the market could rally towards the 50 day EMA, so short-term buyers will probably come in and push this market to the upside. However, I believe that somewhere near that 50 day EMA is about as far as we can go.

Look to signs of exhaustion after rallies in order to start shorting again, because this is a market that is so oversupplied it’s almost impossible to chew through it right now. The Americans have drilled 17% more this past year than they did the previous year, showing just how much natural gas is out there. Natural gas is going to struggle to have a strong pricing anytime soon, so I like the idea of fading rallies at the first signs of trouble. Keep in mind that we are in the dead of winter, and there is talk of colder temperatures at the end of January, which of course should drive the price. But that’s a short-term catalyst, and not a longer-term one like the fact that we have so much in the way of resistance and oversupply out there.

At this point, signs of exhaustion will attract a lot of attention as there are so many longer-term sellers. The alternate scenario is that we break down below the $2.00 level, which would be catastrophic. I don’t think that happens anytime soon, but this bounce should offer an opportunity if you are patient enough. I will look at this through the lens of the daily close in order to start shorting. As far as buying is concerned, you can do that, but you will need to be extraordinarily nimble. Above the 50 day EMA, the $2.40 level should also offer resistance. All things being equal, this is a market that continues to show a lot of negativity and therefore I would take advantage of any opportunity that comes along.