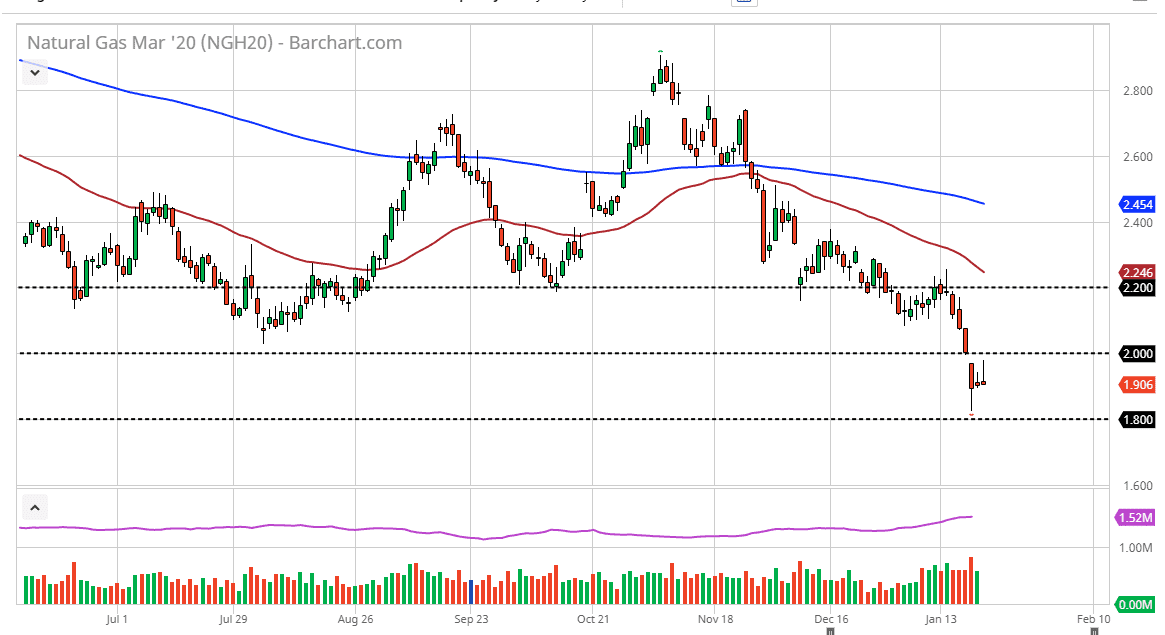

Natural gas markets initially tried to rally during the trading session on Thursday but ran into a lot of trouble at the $2.00 level again. This is an area that we had gapped below on Tuesday as traders came back from the Martin Luther King Jr. holiday. That being said, the area offered enough resistance to turn the market around completely and show signs of exhaustion. At this point, it looks as if the $2.00 level is massive resistance, and if we can break above there it’s very likely that it would be an opportunity to short a market that had gotten ahead of itself.

Unfortunately, even though the market got a little bit more of a bullish inventory figure during the trading session on Thursday, the reality is that now that the futures market is starting to rollover into the March contract, we are going to see market participants start thinking about warmer temperatures. This will drive down demand yet again. This is going to be a very painful year for natural gas companies, and as a result there will certainly be a significant amount of bankruptcies in my opinion. In fact, we are already starting to see credit rating agencies downgrade several of the larger players in the United States and therefore it’s likely that we are going to see this market become very volatile going forward as the oversupply of natural gas continues to cause major issues. If we see some of these companies go under, that might bring down some of the oversupply, but that is an issue for later this year, perhaps even next year. In the meantime, selling rallies will be the best way to go going forward.

I believe that any time this market rallies more than a day or two, it’s time to start selling. It’s very likely that the two dollars level will remain stringent, but if we can break above there and reach towards the $2.20 level, it becomes even more resistive there as well, as we see the 50 day EMA come into play as massive resistance. Regardless, this is a market that cannot be bought. It might be able to have the occasional shot higher due to the winter storm here and there, and you should look at that as an opportunity to get short yet again. If we break down below the $1.80 level, this market follows even further but one has to wonder how quickly you can go to the downside as we are so overextended.