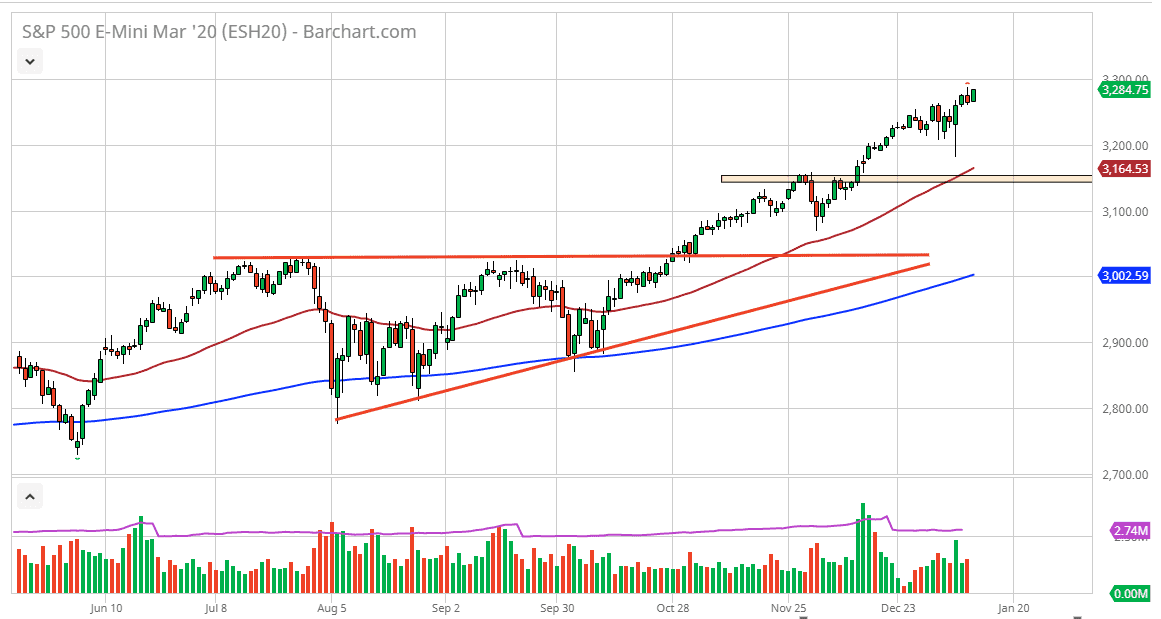

The S&P 500 has rallied quite nicely during the trading session on Monday, and even more importantly found a lot of that buying pressure to be at the end of the day when institutional traders start getting involved. At this point, it looks as if the S&P 500 is ready to take off reaching towards the 3300 level. If we can break above that level, then it’s likely that the market could go much higher. At this point, the market would then allow more momentum and more importantly, money to flow into the market.

Pullbacks at this point should have plenty of buyers, extending down to the 3200 level, perhaps even the 50 day EMA. The market has been very bullish for quite some time therefore I think pullbacks will offer value as the trend has been so strong for so long. At this point, there’s no way to short this market, because quite frankly every time we have pulled back, buyers would come into pick this market up. It continues to show an extraordinarily high amount of resiliency and there’s no reason to think that it’s going to change anytime soon. At this point, the 50 day EMA should be thought of as the “intermediate floor” in the trend. Longer-term I believe that the market is likely to go looking towards the 3500 level as it is a large, round, psychologically significant figure.

I believe that 2020 will be bullish just as 2019 was, but it won’t be as bullish as the previous year. We are starting to see signs of economic weakness in the United States, or perhaps slowing down is a better description, but there are also no fears of the Federal Reserve stepping in and tightly and monetary policy. Markets will continue to favor the upside, but the trajectory needs to slow down because quite frankly it’s not very healthy to have 30% gains every year. In the year 2020, it’s going to be much more important to find value that it is anything else. I still don’t think you can sell this market, but we will get the occasional selloff, but look at that as opportunity, not as a sign to suddenly reverse all of your positions. This market should continue to have a lot of people worried about missing out, and therefore there should be plenty of buyers on the sidelines waiting to take advantage.