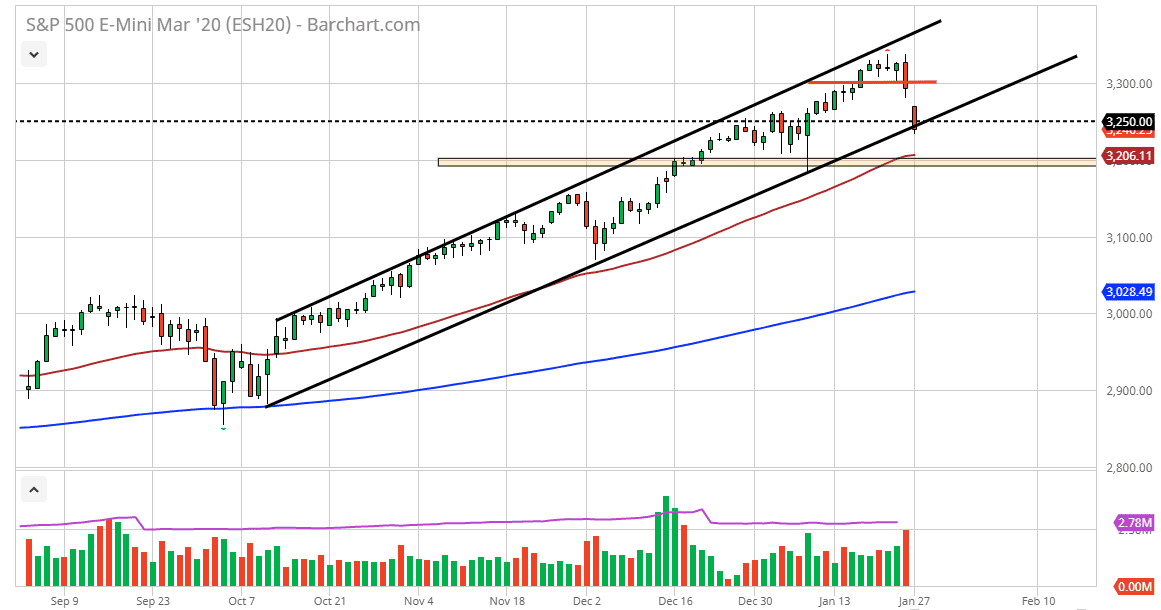

The S&P 500 has gapped lower and broke down rather significantly during the trading session on Monday as traders continue to react to the negativity coming out of China. The uptrend line is being threatened, and if we were to break down below there it’s very likely that the market could go towards the 50 day EMA which is currently at the crucial 3200 level. That’s an area where we have seen support previously, and therefore it’s likely that some type of bounce is ready to happen in this area.

If we were to break down below the 3200 level, it’s likely that the market could go down to the 3100 level. That of course is an area that will attract a certain amount of attention due to the fact that we have seen support in that area, and then by the time we get down there it’s very likely that the 200 day EMA could come into play at that area as well. Regardless, it certainly looks as if the fact that the market has closed that almost the bottom of the range for the day suggests to me that there is further downside coming. I don’t think this is some type of major meltdown, it’s just that the market is overvalued and quite frankly it’s needed some type of significant pullback for months.

You will notice that the last several weeks have been basically green until the last couple of trading sessions. Notice how quickly the market goes to the downside in these areas, which makes buying on the dips very difficult. The easiest way to do that is to buy some type of supportive daily candlestick that you can take advantage of so therefore I will let you know at the end of each trading session as to what I am doing, but I will not be placing the trade in the middle of any particular trading session as the ability to go long should last quite a while as we are most certainly in an uptrend anyway. This could be a very nasty pullback, but sooner or later we will get a supportive daily candlestick that we can take advantage of, and therefore start picking up a bit of value. That is exactly what I will be looking for as far as a sizable trade is concerned. Longer-term, we still have all of the factors in this market that has made it so bullish.