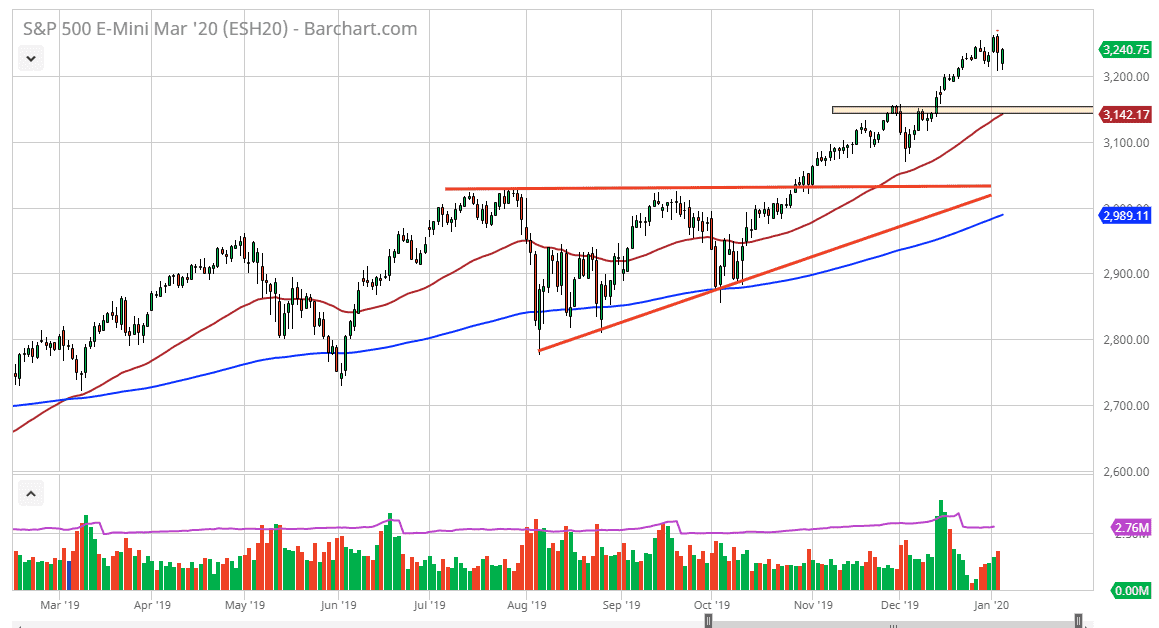

The S&P 500 gapped lower to kick off the week on Monday, and then pulled back towards the lows that we ended up forming on Friday. The 3200 level just below there offers plenty of support as well, so it’s only a matter of time before we go to the upside. Looking at this chart, it’s obvious that it is bullish overall, and I think that traders will continue to look at it as a bullish market. The 50 day EMA is currently testing the 3150 handle, which was the top of the most recent resistance, and now that the two things are coinciding, it makes sense that a lot of buyers would be willing to get involved in that area.

If we were to break through there, and we very well could on some type of overly negative headline, the 3100 level underneath would be support, just as the previous ascending triangle top would be near the 3030 handle. Looking at this chart, the market continues to find pullbacks as buying opportunities, and that makes quite a bit of sense considering that the Federal Reserve will continue to pick the markets up. Overall, we are in an uptrend and there’s no reason to fight that situation.

To the upside I anticipate that the 3300 level will be targeted initially, but the real target will be closer to the 3500 level. The market is getting a little bit overextended so in the interim we may simply see a lot of grinding back and forth, but at this point building up momentum is probably going to be where it is necessary. Expect volatility and of course headline risk, but we still have the overall momentum and therefore there’s no reason to fight that action. If you do find the market following, simply look for a bounce to get involved but you should probably look to build a position slowly, because we have so much in the way of potential landmines out there to keep the market on its toes. Expect the unexpected, but I still favor the upside and there’s no reason to think that anything is going to change barring some type of major breakdown in confidence. Considering that the markets have recovered already from the assassination of the Iranian general, I think it shows the true resiliency that this market will continue to be a beneficiary of.