The S&P 500 initially pulled back a bit during the trading session on Wednesday, in reaction to the Iranians sending missiles towards the Americans in Iraq. However, it was obvious shortly afterwards that it was not an attempt to actually kill any American troops, so as a way for Iranians to save face without escalating the situation to drastically. With that, it’s likely that the market will look at this as an opportunity for things to cool off, and comments from the Iranians suggested that they were looking to keep things as were and weren’t interested in escalating the situation if they could avoid it. Later on, in the day, the Americans via President Trump stated that there would be more sanctions, but military action wasn’t in the plan.

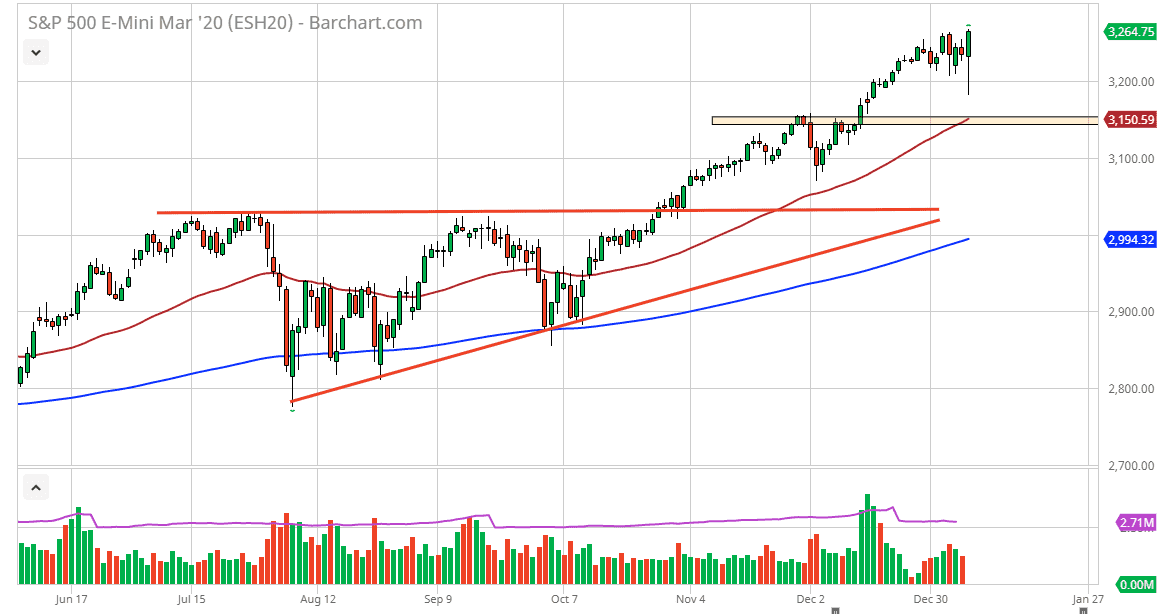

Looking at the chart, we had been in an uptrend for some time anyway, and the fact that the 3200 level offered support should not be a huge surprise. By turning around the way we have and eventually at one point in the day making a fresh, new high, this is a market that looks like it is ready to go higher over the longer term, but Thursday might be a bit quiet due to the fact that the jobs number comes out on Friday. Keep in mind that the jobs number will have a major influence but all things being equal this looks like a market that still should be bought on dips. I believe that the 3150 level will be supportive due to the fact that it was the previous resistance area and of course the 50 day EMA is currently in that area. That should offer enough technical support to offer a bit of a “floor” in the market.

If we did break down below their it’s likely that the market would find support at the 3100 level as well. All things being equal, I believe that the market does go higher, but it will probably be more of a grind than an explosive move. Monday should be the beginning of the normalcy when it comes to the markets as volume will pick up. Given enough time, this is a market that I think does reach towards the 3500 level, as liquidity continues to be pumped into the marketplace. That being said, look for pullbacks to take advantage of value going forward, as we are a bit stretched to say the least.