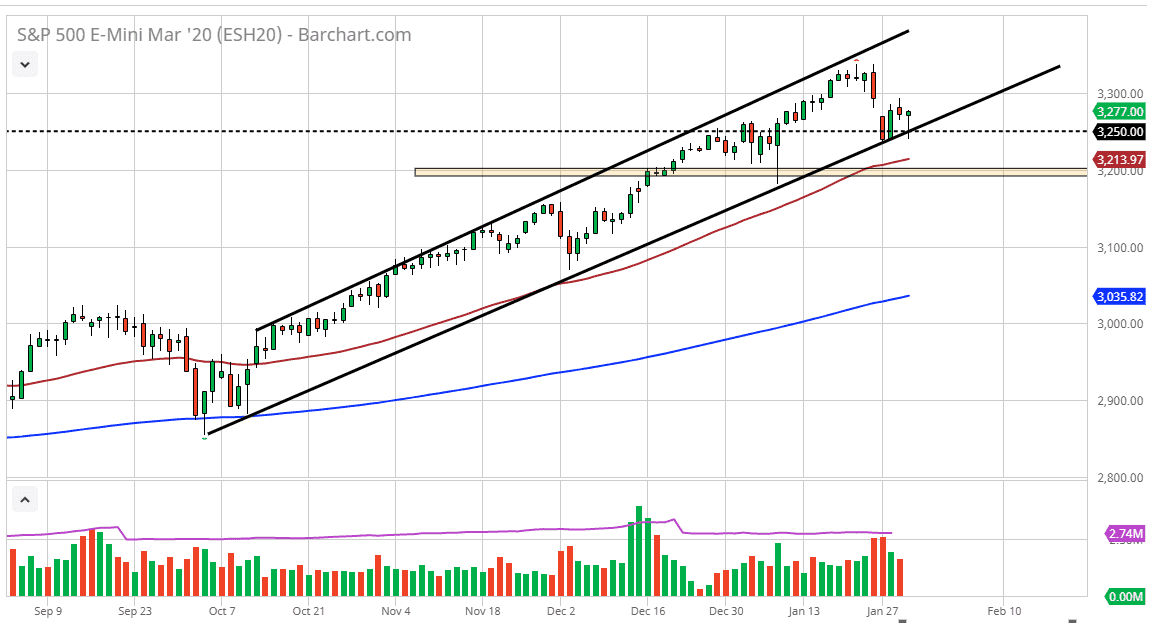

The S&P 500 initially dipped during the trading session on Thursday, reaching down towards the 3250 level, an area that has been very supportive. That being said, the uptrend line has held as well, which is the bottom of the overall uptrend channel. The 50 day EMA underneath is also supportive, hanging around the 3200 level. Ultimately, as long as we can stay above that area, I believe that the S&P 500 will continue to go higher.

Market participants will continue to look at this as a market that is in a very bullish trend, and therefore should continue to go much higher. If we can break above the 3300 level, then it’s likely that the market will go looking towards the highs again, as it would be close to the top of the overall up trending channel that the market has been kept in for quite some time. Ultimately, I do like the idea of buying these dips as they occur, and I think at the last couple of days have been a tremendous buying opportunity.

I am starting to notice a pattern here, meaning that during the Asian and European trading sessions, the S&P 500 futures market will sell off, but once it comes down to just the Americans, they are buying these dips as they recognize that the end of the world hasn’t come with the coronavirus. It is probably only a matter of time before the rest of the world catches on, and therefore it will be interesting to see how this plays out. Beyond that, earnings season in the S&P 500 has been rather good, as the US economy continues to climb higher. With that being the case, it makes quite a bit of sense that we eventually go higher and continue to make a fresh, new high.

If we do break down below the 3200 level, then it’s very likely that the market goes looking towards the 3100 level which is the next supportive level, which also should coincide nicely with the 200 day EMA. That is based upon the projection of a downward trend catching up to the EMA which is still rising. Nonetheless, I don’t think that happens in the short term, nor even in the intermediate term. All things being equal it’s very likely that we should continue to go much higher, reaching towards 3500 over the longer term.