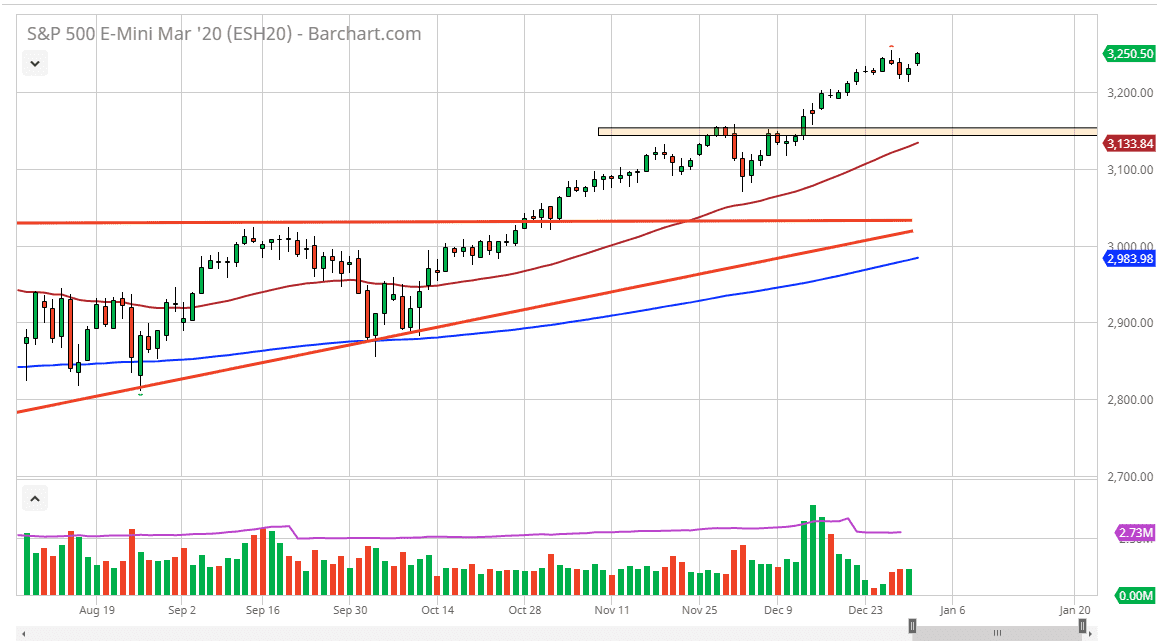

The S&P 500 rallied a bit during the trading session on Thursday, lagging behind the NASDAQ 100 which has already broken out. It looks as if the S&P 500 is ready to make that same move as well, and therefore at the first signs of strength it’s probably ready to break out. That would be a very good sign, considering that the recent high was a shooting star and anytime you break the top of a shooting star, that’s an extraordinarily bullish sign.

Looking at this chart, the 3200 level should be supportive, and I do recognize that the 3150 level will also be massive support as the 50 day EMA is starting to cross that area. Beyond that, that’s an area that had previously been resistance, so “market memory” should come back into play. With that being said, I like this chart and I do think that it goes much higher. I believe that there will be plenty of people looking to get involved now that the calendar has rolled over, and therefore they have to put positions to work for their clients. There are plenty of reasons to think that the market will continue to go higher, but it probably won’t be as strong as it was last year. After all, the S&P 500 gained roughly 33%.

With that, I like the idea of short-term pullbacks, as they offer a little bits and pieces of value, but this is a longer-term trend and therefore you have to be cautious about putting too much money to work in one shot. We will have pullbacks occasionally, but the US/China trade deal starting to work itself out will continue to work in favor of this market. Furthermore, there are signs that perhaps the Federal Reserve will have to loosen rates later in 2020 and that of course will drive the stock markets to the upside. Ultimately, this is a market that will also need to pay attention to global growth, which is a little bit lumpy at the moment but currently it appears that the United States is leading the way for most economies, so it makes sense that the S&P 500 should strengthen, especially in relation to many other economies around the world. With that being the case, the market is in a longer term uptrend and that can’t be fought. Dips continue to offer plenty of value, but it looks as if we are ready for a breakout and that should happen rather quickly.