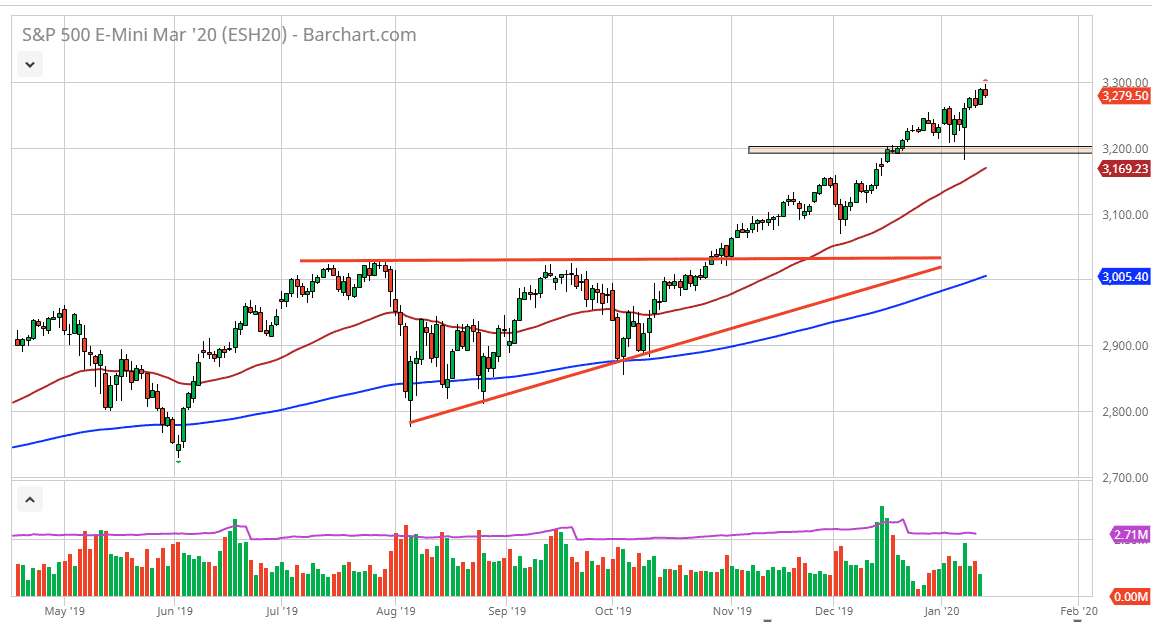

The S&P 500 initially tried to rally during the trading session on Tuesday but continues to struggle with the idea of the 3300 level. It did get a bit of a boost initially due to the Citigroup and JP Morgan earnings beating estimates, but we have turned around to show signs of exhaustion. I don’t think it’s a big deal, I just think that the market is trying to build up enough momentum to finally break above the psychologically important 3300 level.

If that’s going to be the case, we may be able to find a bit of value here near the 3200 level, but I would also be interested in the 3250 level. Obviously, if we can break above the 3300 level it would be a sign that we could continue to go much higher, and that opens up the door for a move as high as 3500 over the longer term. I think that does happen given enough time, but in the short term it looks like we will pull back in order to find plenty of buying pressure. The 50 day EMA is starting to reach towards the 3200 level, so that’s obviously an area that will attract a lot of attention due to not only the psychological importance of the round number, but the 50 day EMA being paid attention to as well. Ultimately, the hammer that sits right at the 3200 level also offers another clue as to where the buyers would jump in.

At this point, I have no interest in shorting this market because I believe that there are plenty of reasons that we will rally over the longer term, not the least of which will be the earnings that are better than anticipated. Furthermore though, the Federal Reserve is on the sidelines and willing to step in to pick the market back up, as they have done for over a decade. A nice brutal selloff will only be thought of as a buying opportunity at this point in time. We are probably a little bit overdue for that, but the real trade is to simply buy once the market stabilizes after a breakdown. Selling has been a good way to lose money for ages now, and even though you can make a lot of arguments as to why the market should continue to go higher, the reality is that it has, and will going forward.