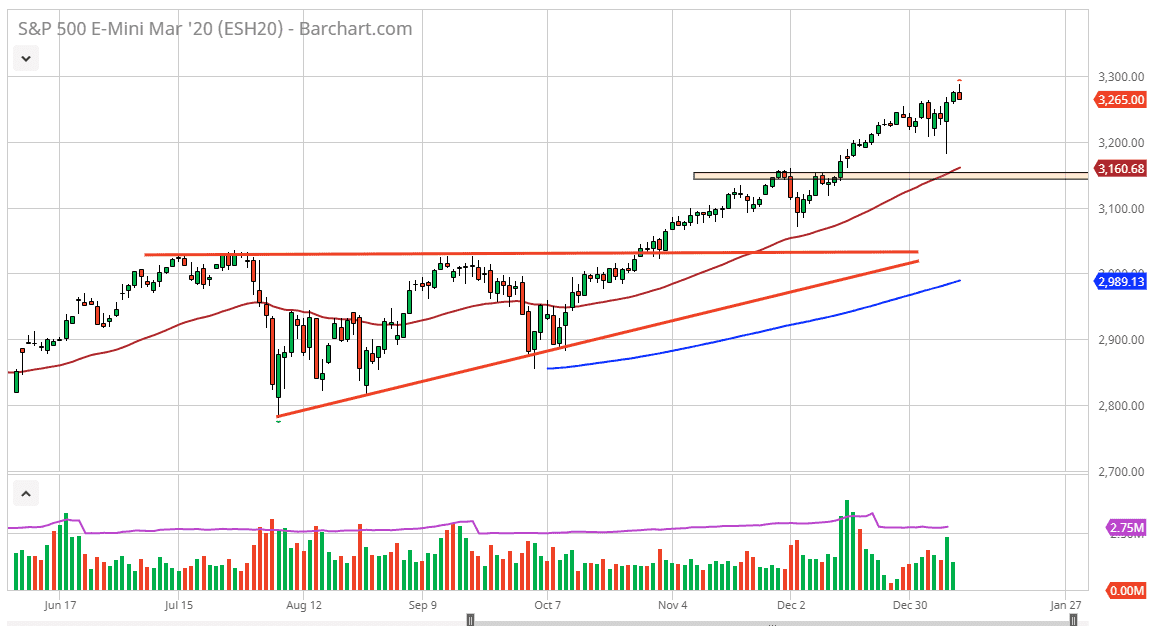

The S&P 500 has initially rallied during the trading session on Friday, but the jobs number was a bit disappointing in the United States. It wasn’t disastrous, so I don’t expect any type of major breakdown. At this point, it’s very likely that the market will find plenty of buyers underneath, as the market has been so strong for quite some time. All things being equal, I think that the market does go higher basically because of the trend and the pullback on Friday will have been more or less thought of as an excuse to collect some gains. That 3300 level of course has a certain amount psychological importance attached to it, but even more so I believe that the volume is still a little bit anemic.

The market will more than likely pull back in the short term, before turning around to show signs of life again. At this point, the market is likely to see a lot of support at the 3200 level, and at this point it looks as if the 50 day EMA is starting to reach towards that level. As traders come back to work from the holiday season, they will start to put on positions for the year. A lot of money managers will have to get involved, and that should continue to lift the S&P 500 as not only do we have a relatively strong economy in the United States, but not so strong that the Federal Reserve will get involved. As long as we have easy money, it’s very likely that this market will continue to go higher unless of course we get some type of major negative headline crossing the wires. There is the possibility that happens, but at this point it’s very unlikely that it will be anything more than a pullback that you can take advantage of as it has been so bullish for so long. We have seen several headlines coming go, but at the end of the day it’s always bounced from those levels. Until something fundamentally changes from a longer-term standpoint, buying dips should continue to work. Speaking of dips, I believe that we will get an opportunity to pick up a bit of value here and therefore I am looking forward to the next couple of days drifted lower so that I can add to an already long position. Selling isn’t a thought at this point.