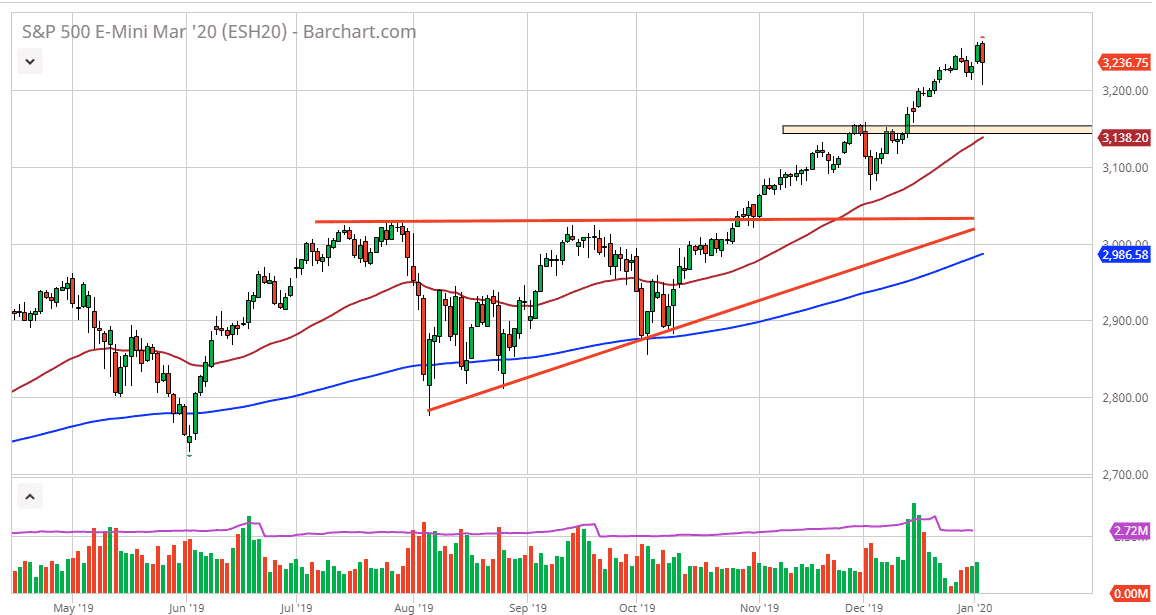

The S&P 500 broke down significantly during the Friday session after it was announced that the Americans had killed and an Iranian general, which of course is a very spooky turn of events from a geopolitical aspect. However, it should be noted that most if not all of the selling was done through Asian and European outlets, and by the time the Americans came on board, the S&P 500 turned around quite drastically. By forming the temp candlestick, it has, it shows that perhaps the market isn’t quite ready to fall apart yet and that the 3200 level looks to be very supportive.

Underneath there, I believe that the market finds plenty support at the 3150 level and of course the 3100 level. The 50 day EMA is getting rather close to the 3150 level so that should also attract a certain amount of attention in and of itself. I have no interest in shorting, I believe that if we do pull back a bit, it will more than likely offer a buying opportunity based upon value in what has been a very strong uptrend.

For a longer-term target I like the idea of 3500 but I don’t think it’s can happen in the short term. I continue to look at pullbacks as offering value in a market that is obviously a very bullish and probably counting on the Federal Reserve to catch it if it does in fact fall. Ultimately, this is a market that I think will continue to look at pullbacks as basic value and there are plenty of traders out there that will be looking to take advantage of what has been an obvious move. Yes, 2019 was extraordinarily bullish, gaining over 30%. However, 2020 seems to be very unlikely to be as bullish. That doesn’t mean that it can’t be bullish, just that it won’t be as strong. In other words, we will probably have to work a bit harder this year for the gains. Think of it this is a market that is going to simply grind away to the upside. Yes, there will be the occasional problem and sell off, but ultimately those will probably be of the short term variety. I believe that we are going to go looking towards the 3500 level sometime this year, but it isn’t going to be straight up in the air like we had previously enjoyed.