The S&P 500 initially pulled back a bit during the trading session on Wednesday but has rallied again to show that there is a significant amount of buying pressure and people out there looking to take advantage of value. This was the same day that we have seen the Americans and the Chinese sign the “Phase 1 deal”, which of course is bullish for the market overall. Having said that, it has already been priced in, so I don’t think that we get a move higher based upon that solely. That being said, it doesn’t really matter why the markets are going higher, just that they are.

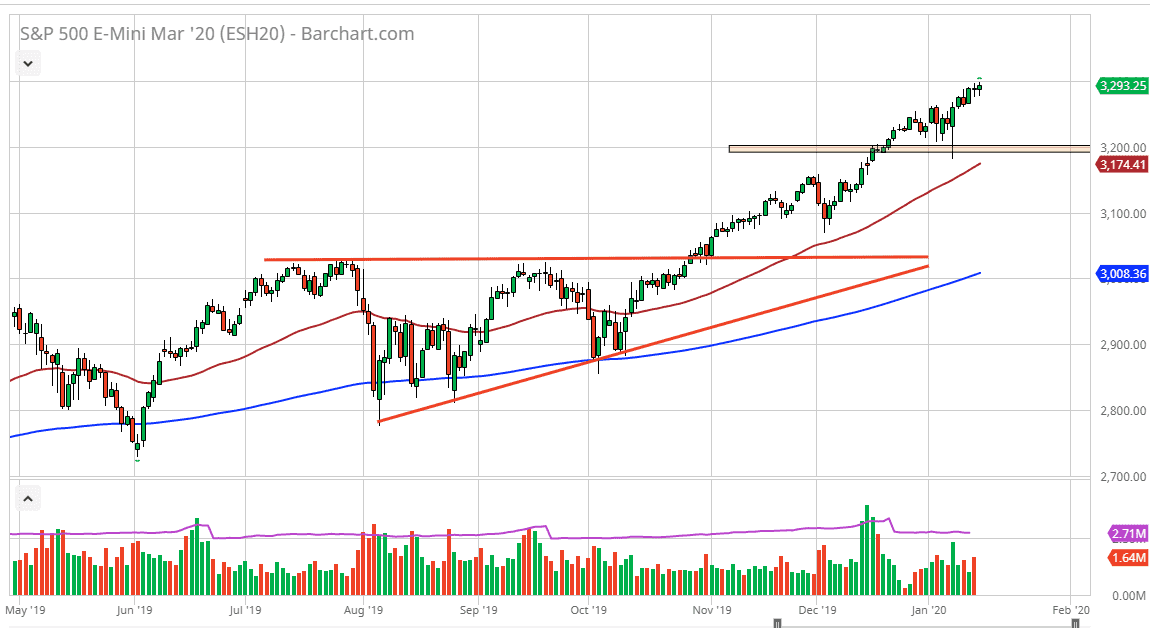

The 3300 level above is resistance, but it is only a matter of time before we continue to go to the upside. Pullbacks at this point should be supported quite nicely at the 3200 level, as well as the 50 day EMA showing up that level will offer a buying opportunity as well. I have no interest in shorting this market at all, at least not until we get some type of huge fundamental shift in the marketplace. That being said, the markets have been rallying on one major reason for the last decade: Federal Reserve liquidity.

The Federal Reserve will remain very loose with its monetary policy, and that should continue to be what the market focuses on in general. In fact, you can take a chart of the S&P 500 and a chart of the Federal Reserve balance sheet and see that they are essentially the same chart. In other words, the markets continue to see money flow into them because quite frankly there are no returns anywhere else. The bond yields are an absolute joke, and as long as that is going to be the situation, the stock market continues to go higher.

The choppiness on the way up will continue to offer pullbacks but those pullbacks offer value. That is exactly how most traders have been looking at it over the last several years, and it is almost like clockwork that the buyers will return based upon value. Looking at this chart, the 200 day EMA is almost 300 points underneath, and that speaks to just how bullish this market has been. It might be slightly overbought, but again I believe that every time the markets pulled back there will be plenty of buyers to pick up value as it presents itself.