Tensions in the Middle East are likely to intensify after the US killed a top Iranian general in Iraq. This prompted the Iraqi government to pass a resolution to expel all foreign troops, and US President Trump threatened sanctions against Iraq. Safe-haven assets like the Japanese Yen rallied, but a pause is anticipated as bearish momentum is recovering. The USD/JPY recorded a lower low but was able to eclipse its support zone. A short-covering rally is expected to follow the breakout, while the long-term downtrend is likely to remain intact.

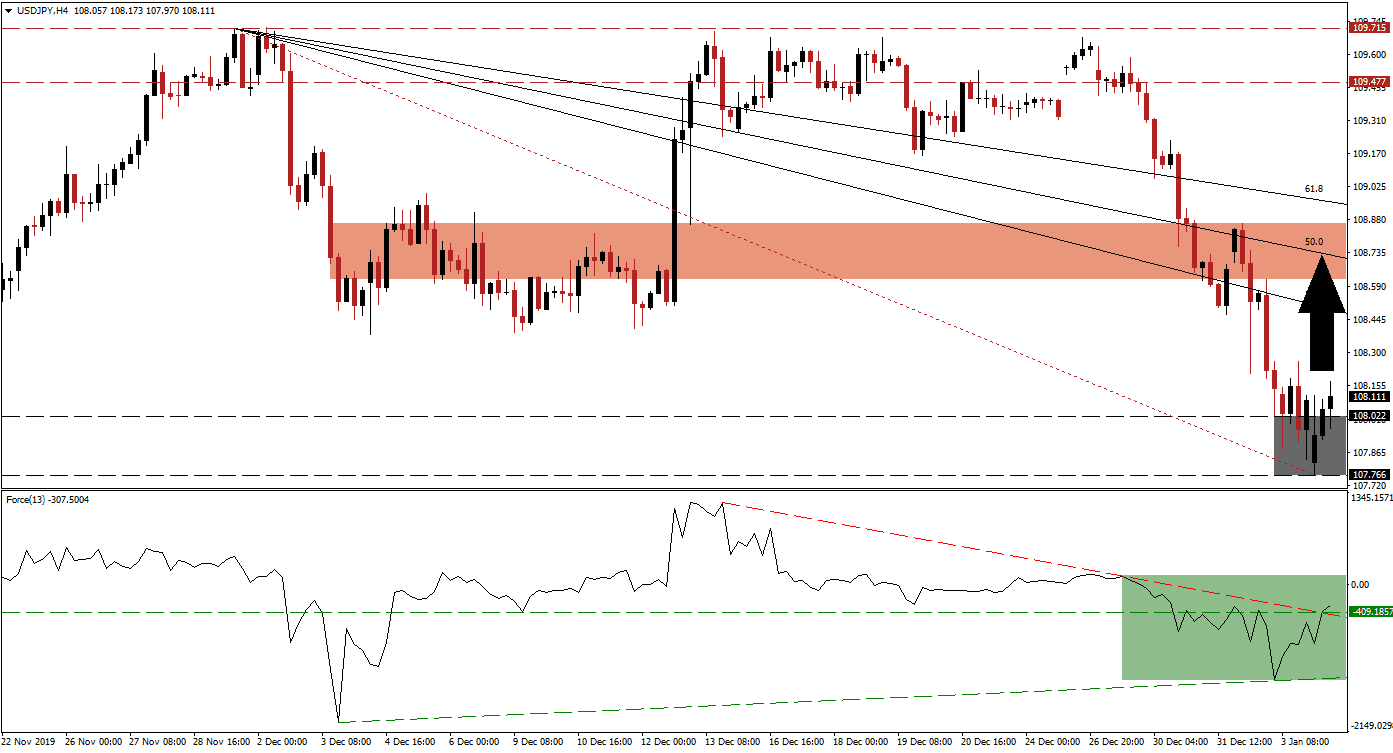

The Force Index, a next-generation technical indicator, descended to a higher low and a positive divergence materialized. This served as an early indicator that a price action reversal in the USD/JPY may be imminent. The Force Index accelerated to the upside, off of its ascending support level. Bullish momentum sufficed to convert its horizontal resistance level into support, as marked by the green rectangle. This technical indicator additionally pushed above its descending resistance level, from where a move into positive conditions is favored. You can learn more about the Force Index here.

After the breakout by this currency pair above its support zone located between 107.766 and 108.022, as marked by the grey rectangle, a short-covering rally is anticipated to close the gap to its descending 38.2 Fibonacci Retracement Fan Resistance Level. Forex traders are advised to monitor the intra-day high of 108.263, the peak of a failed breakout attempt. A move in price action above this level is expected to result in the addition of net long positions in the USD/JPY, fueling more upside. You can learn more about the Fibonacci Retracement Fan here.

Due to the long-term bearish fundamental outlook for the USD/JPY, the upside potential remains limited to its short-term resistance zone. This zone is located between 108.620 and 108.862, as marked by the red rectangle. The 50.0 Fibonacci Retracement Fan Resistance Level is passing through this resistance zone and expected to reverse the pending advance. Besides the most recent escalation in geopolitical tensions, the global economy is likely to slow down further. Recession signals continue to flare up, supporting safe-haven assets. Any advance in this currency pair should be considered a great short-selling opportunity.

USD/JPY Technical Trading Set-Up - Short-Covering Scenario

Long Entry @ 108.100

Take Profit @ 108.700

Stop Loss @ 107.900

Upside Potential: 60 pips

Downside Risk: 20 pips

Risk/Reward Ratio: 3.00

A breakdown in the Force Index below its ascending support level is expected to lead to more downside in the USD/JPY. This will invalidate a short-term reversal and extend the dominant long-term bearish chart pattern. The next support zone is located between 106.481 and 106.806, from where more downside is favored. A series of lower lows and lower highs is likely, given the worsening outlook on multiple fronts.

USD/JPY Technical Trading Set-Up - Breakdown Scenario

Short Entry @ 107.500

Take Profit @ 106.500

Stop Loss @ 106.850

Downside Potential: 100 pips

Upside Risk: 35 pips

Risk/Reward Ratio: 2.86