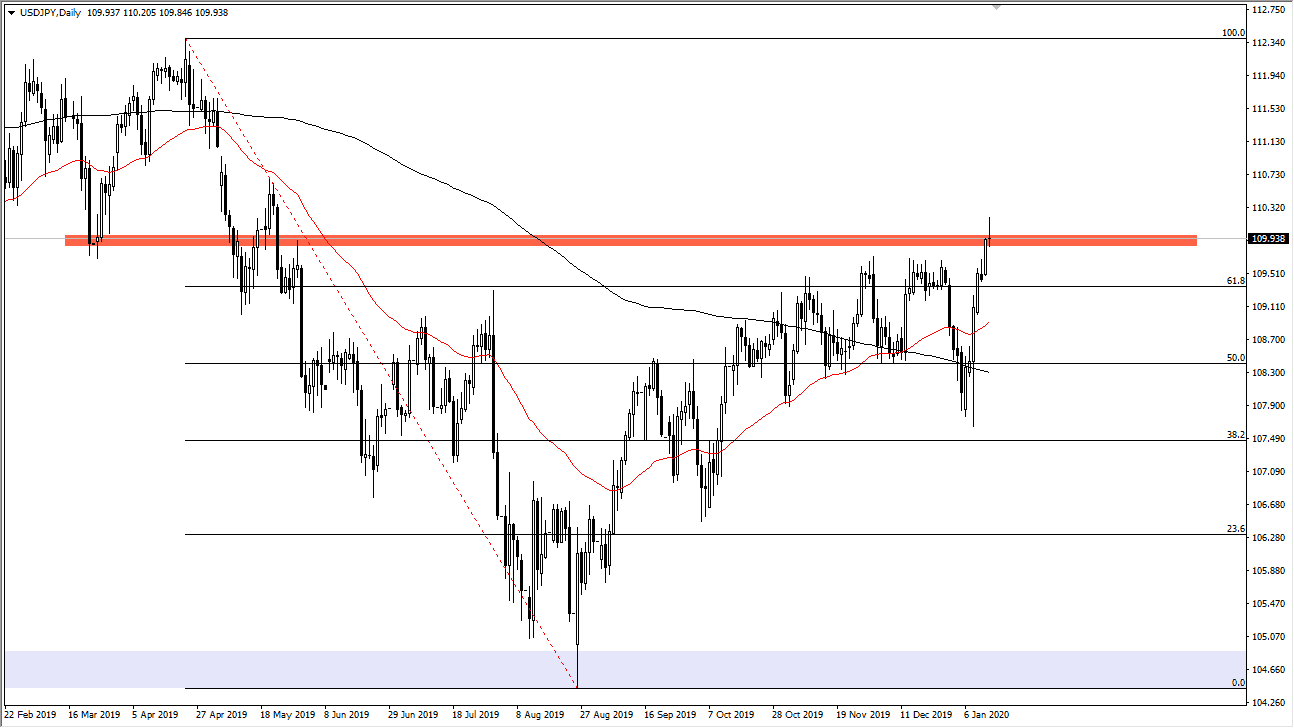

The US dollar rallied a bit during the trading session on Tuesday but gave back most of the gains in order to pullback and form a bit of a shooting star. While that is a very negative candlestick, the reality is that we are overextended more than anything else. I don’t necessarily think that this is the opportunity to start selling this pair, but I think it tells us that the market probably needs to pullback in order to find a bit of value. That value is something that you should be paying attention to, as the ¥110 level of course is an area that is important. It psychologically resistive, but then again, the market has broken down from that area to cause what is now starting to become a bottoming pattern. We are now testing the very top of that move lower, and it’s obvious that it’s going to take a lot of work to get through there.

If we were to break above the top of the candlestick for the session on Tuesday, it’s likely that the market will go higher, perhaps reaching towards the ¥111 level. If they were to break out above there, then the market is likely to go looking towards the ¥112.33 level as it is the 100% Fibonacci retracement level. You can see that the market had broken above a shooting star from a couple of days ago, and therefore reached towards this area right here. However, if the market was the pullback from here, I think somewhere near the ¥109.50 level we would see buyers, and then the ¥109 level after that.

I do believe that given enough time the market is going to go higher, but as we had turned around so drastically in the middle of last week and then shot straight up in the air, it’s likely that the market is simply running into a bit of exhaustion. That isn’t a huge issue, but we have made a “higher high” as of late, and that shows that the buyers are starting to take control, but the market can only go so far in a short amount of time. Because of this, I believe the looking for value and I would also pay attention to the stock markets as they are a good proxy as to what’s going on over here as well, as the Japanese yen is considered to be a “safety currency.”