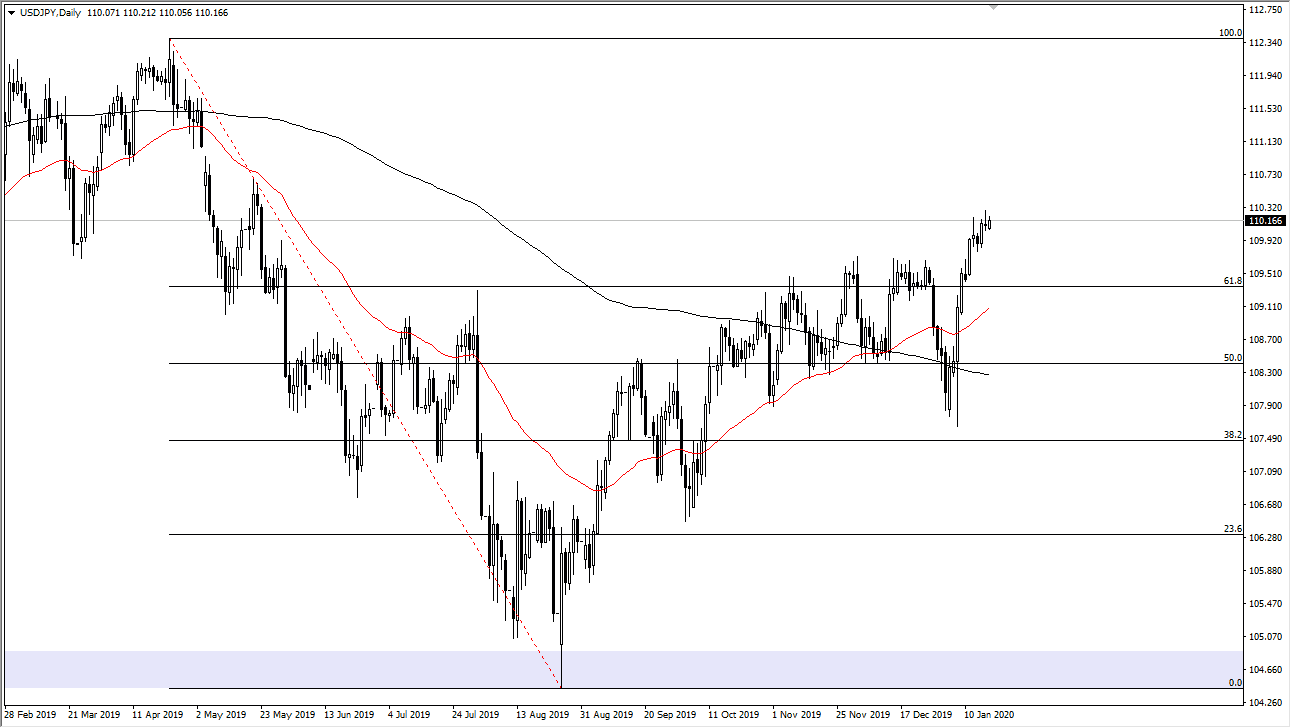

The US dollar has rallied slightly during the trading session against the Japanese yen on Monday, but you should keep in mind that it is Martin Luther King Jr. Day in the United States, which means that Americans work at their trading desks. That being said, we are pressing the top of a shooting star from the Friday session, and breaking above that of course is a very bullish sign. At that point, it’s likely that the market would try to go towards the gap above at the ¥111 level.

At a pullback from here, the market is likely to have a lot of support found at the ¥109.60 level, assuming that the ¥110 level doesn’t offer buyers. We are a bit overextended, so it would make sense that we get that pullback, but quite frankly I feel it’s only a matter of time before the value hunters would step back in and try to take advantage of this move.

Keep in mind that this pair does tend to move with risk sentiment, so as long as everybody’s in a good mood when it comes to assets, this pair should continue to go higher. If we do break down significantly, it’s very likely to do with the idea of risk falling off. Geopolitical issues will drive money into the Japanese yen, but we are also seen signs of the Bank of Japan getting even looser with its monetary policy that it is now, which of course will drive money away from the currency concurrently. Looking at this chart, it’s obvious that something has changed in attitude, meaning that the buyers will more than likely continue to run the show. As long as that’s the case, it’s very likely that we will see value hunters come back, and that is something that should continue to help this market going forward. There are a lot of noises just waiting to happen in this market, and at this point it’s likely that the headlines will continue to throw this market back and forth, but I do think that eventually we will find some type of run towards the ¥112.33 level at the 100% Fibonacci retracement level. I do anticipate a pullback coming, but it’s very likely that should be thought of as an opportunity more than anything else. At this point, simply waiting for an opportunity to pick up value is the best way going forward.