The US dollar has been all over the place against the Japanese yen during trading on Wednesday, in a huge flurry of headlines causing risk appetite to go back and forth quite wildly. It all started early in the trading session, as the Iranians sent a dozen or so missiles towards the US bases in Iraq, but eventually word got out that they hadn’t actually aimed towards the bases themselves, and no US personnel were hurt, and quite frankly almost no damage was done. With that being the case, it was largely a symbolic move, which is much better than the feared move that people had been looking at.

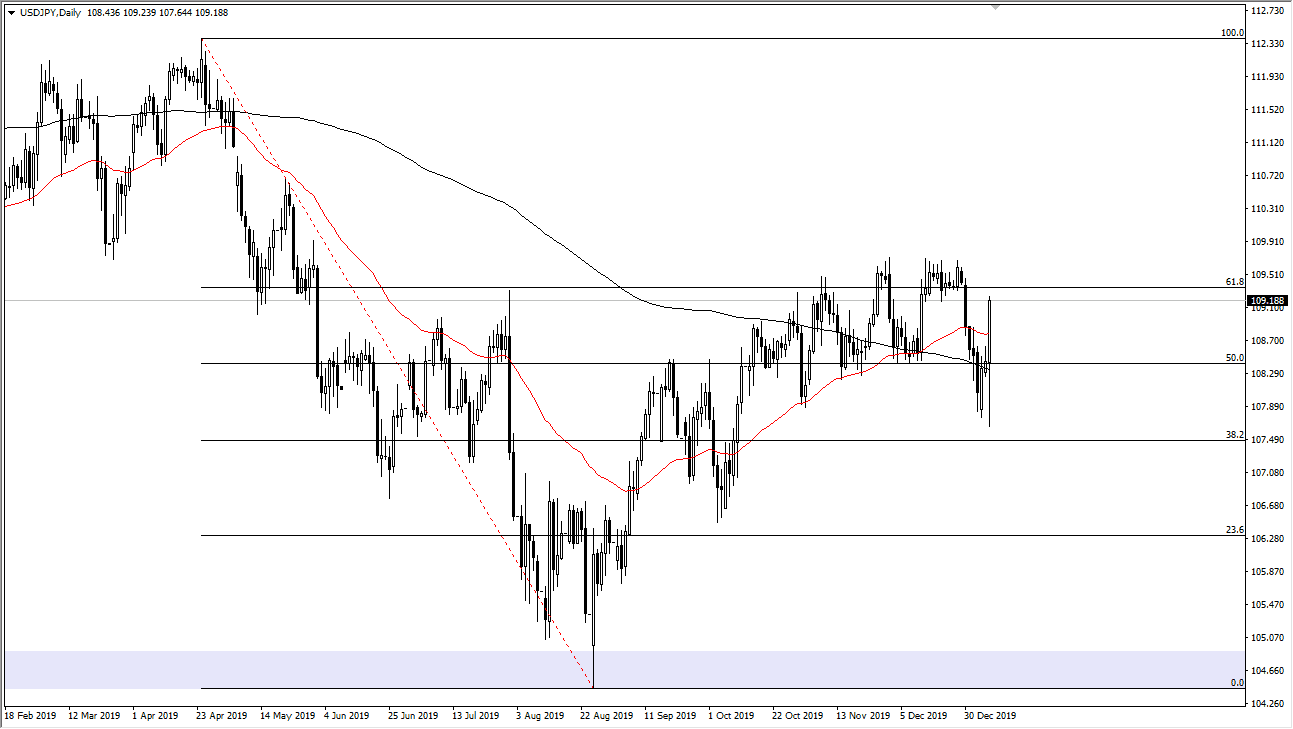

As people ran away from the Japanese yen, we started to pick up momentum to the upside. The ADP Employment Change figure came out much better than anticipated as well, and that was more or less the mix needed to send this market to the upside. At this point, it looks like the market is ready to go back towards resistance again at the ¥109.60 level, an area that has been the gatekeeper to higher pricing for some time. If we can break above that level then it’s likely that we will take out the ¥110 level, and then the ¥111 level. Longer-term it would send this market looking towards the ¥112.50 level.

To the downside I would expect to see the 200 day EMA, pictured in black on the chart, to offer a bit of support. Thursday is the day before Non-Farm Payroll figures, so it might be a relatively quiet trading session. That being said, it’s a bit difficult to get long of the market right now, so I would look for short-term pullbacks as buying opportunities but also recognize that there is only so much momentum that will enter the market over the next 24 hours. Beyond that, I also recognize that there is only so much room to the upside so keep that in mind as well. That being said, I have no interest in shorting this market, as I think we will continue to see more of a “risk on” type of scenario. With that, I remain bullish and I do think that we eventually break out to the upside, but we need some type of catalyst to send this market further to the upside as the overall grind continues. Going forward, buying short-term dips will probably continue to work out.