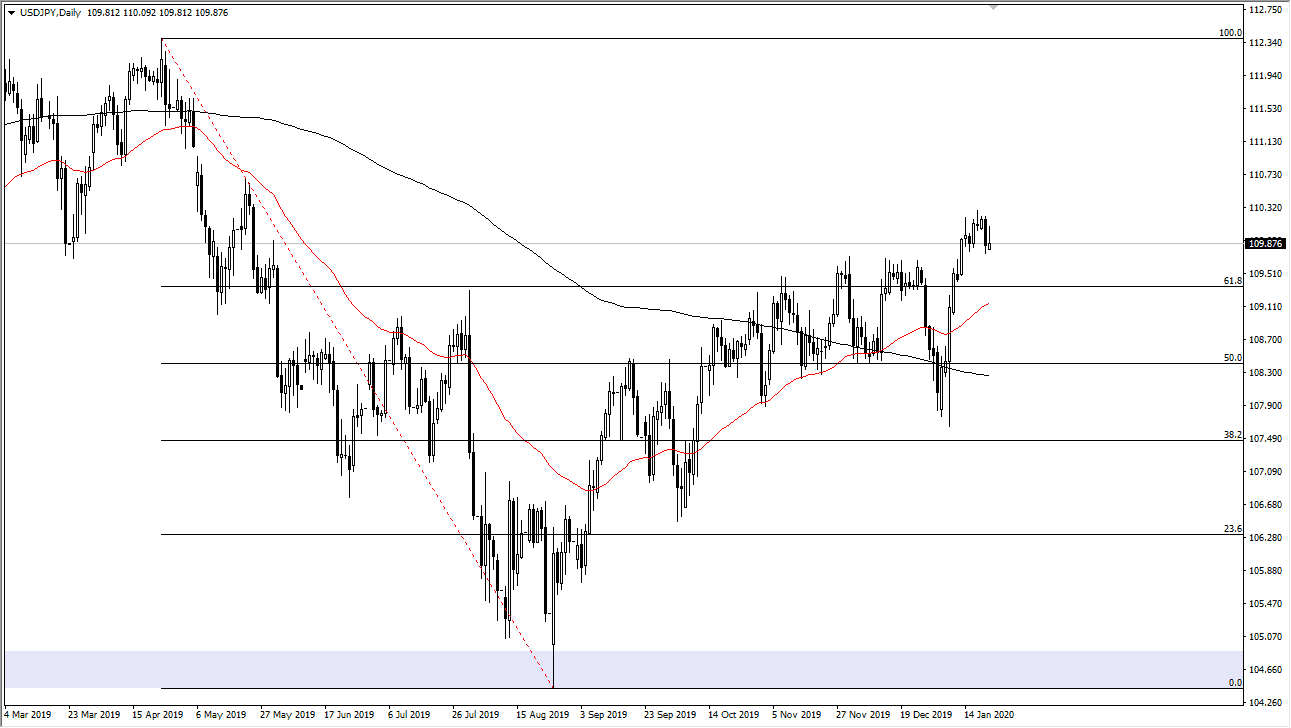

The US dollar tried to rally during the trading session on Wednesday but gave back quite a bit of the gains in order to form a less than impressive candlestick. That being the case, if we break down below the bottom of the candlestick for the Wednesday session it will complete the negativity that we had seen on Tuesday. This isn’t a selling signal from what I see, rather it is a sign that the market needs to pullback as it had gotten a bit overextended, something that I had thought anyway.

I believe that there is plenty of support down at the ¥109.50 level, and that of course the ¥109 level. This is a market that is very sensitive to risk appetite so keep in mind that stock markets can and will move somewhat in tandem when it comes to this market. Going forward, the market is likely to find plenty of buyers in both the USD/JPY pair, but also the S&P 500 which tends to have a reasonable amount of correlation between the stock market and this pair. You can also see that the most recent move was rather explosive to the upside, so it’s very likely that if we can pull back from here, it will find plenty of buyers underneath.

Furthermore, the 50 day EMA underneath should offer plenty of support, so be willing to take advantage of a bounce in that general vicinity. If we can find some type of bounce between here and there, it would be a very bullish sign that momentum is ready to continue picking up and go to the upside. I recognize that this pair is going to continue to have a lot of resistance above, but I think that we will eventually make our way to the ¥111 level, as it is where we see a gap, and then I believe after that we could go to the ¥112.33 level, which is the 100% Fibonacci retracement level. Ultimately, I think that we go much higher but it’s probably going to be a very noisy affair on the way up, and at this point I have no interest in shorting this market because it has been so resilient as of late, and of course we have seen the Japanese yen lose quite a bit against other currencies simultaneously. With this, I am bullish but I’m looking to find support underneath before putting money to work.