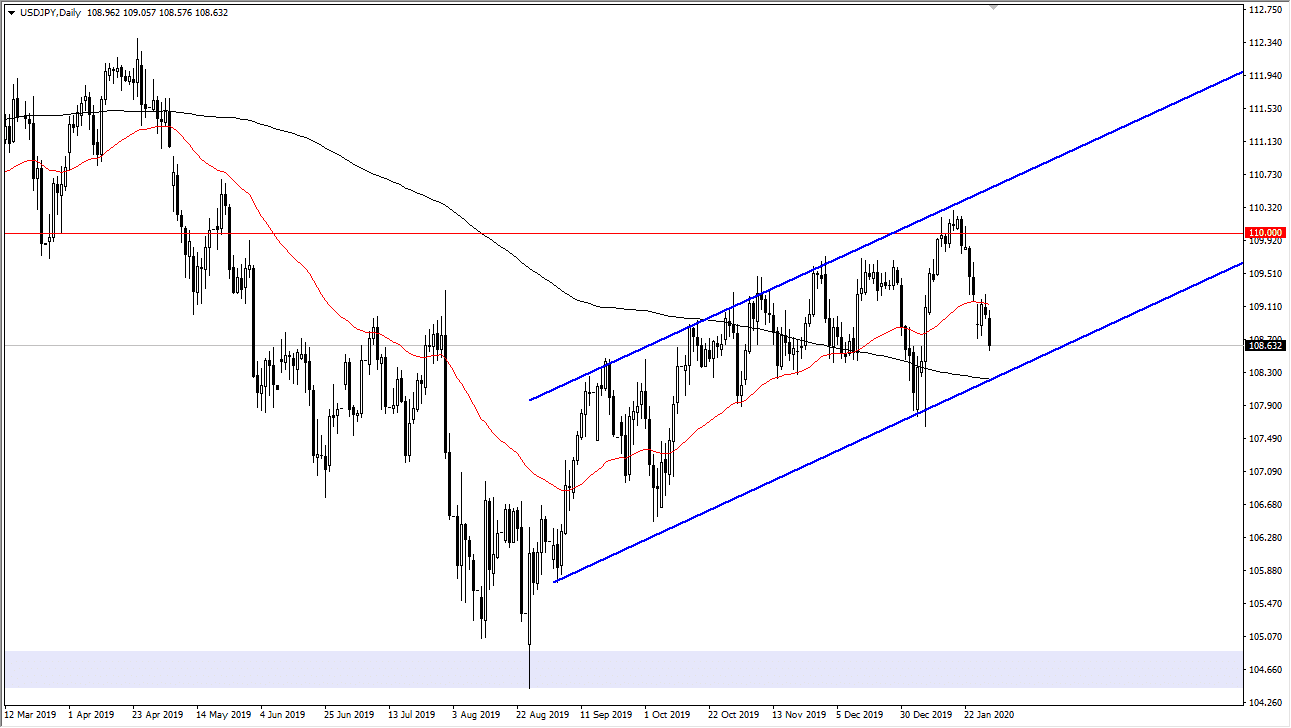

The US dollar has pulled back a bit against the Japanese yen during the trading session on Thursday, reaching towards the ¥108.50 level. We are starting to see a few buyers in that area though, so it’s only a matter of time before we get some type of bounce. Ultimately, you should also take a look at the 200 day EMA underneath and the up trending channel. With that being the case it’s very likely that the market will continue to see more of an upward trend, and it’s only a matter of time before relief comes. Keep in mind that this pair is highly sensitive to risk appetite around the world and therefore it’s interesting to see what happens next as we are certainly approaching an area where you would expect buyers to come back in.

To the upside, we have the 50 day EMA that needs to be overcome in order for the market to go towards the ¥110 level. That’s a large, round, psychologically significant figure that will be difficult to overcome, but given enough time I fully anticipate that we will if the stock market can recover the uptrend that they had been in for so long. After all, the market is highly sensitive to risk appetite, and the S&P 500 is one of the most obvious places to look for signs as the where we are getting ready to go. Ultimately, if the market was to break down below the 200 day EMA, then it’s likely that the market would go down towards the ¥105, as it is the bottom of the largest consolidation area from the longer-term charts.

All things being equal though, if we can break out to the upside you can see the market then try to get towards the ¥111 level where we had previously, and then the ¥112.33 level which was a major area in the past as well. I would anticipate a lot of volatility more than anything right now, and truthfully you will probably get more “bang for your buck” if you were to trade the Japanese yen against other currency such as the Australian dollar or even the New Zealand dollar. With that being the case, the USD/JPY pair could be thought of as a secondary indicator in that scenario, as you can find much more return in some of these other markets right now.