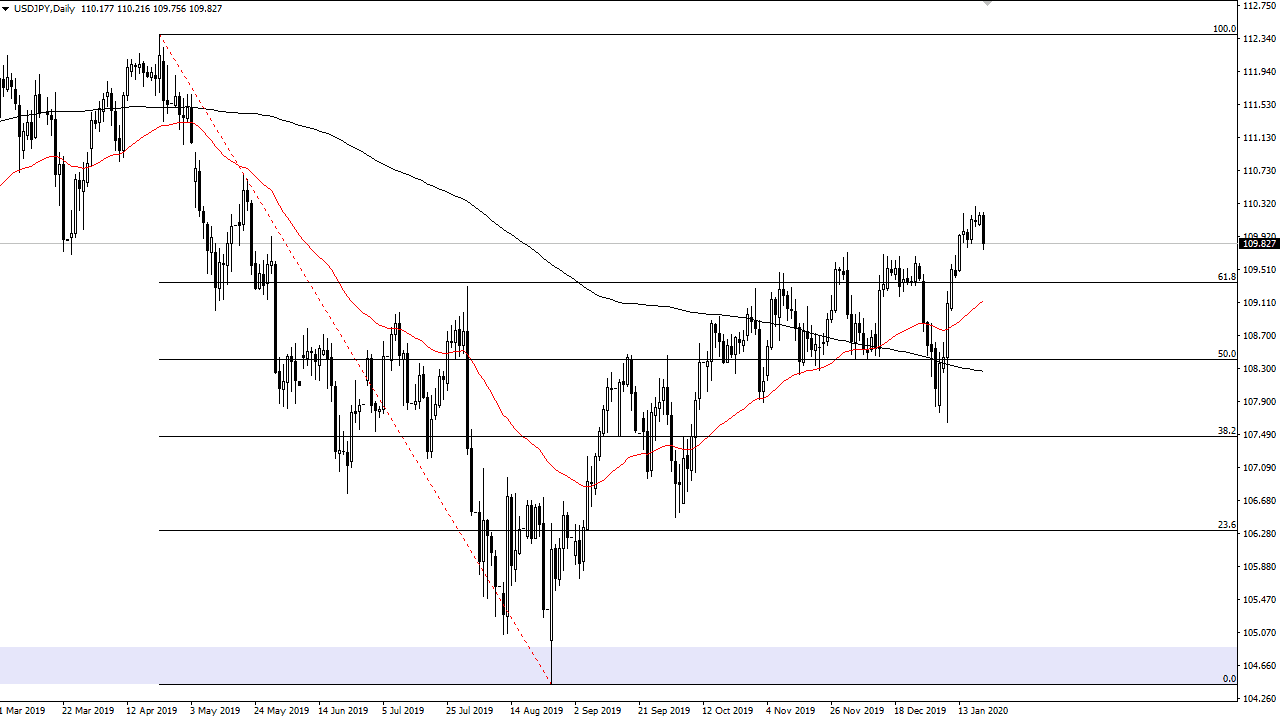

The US dollar has broken down significantly during the trading session on Tuesday, grinding below the ¥110 level later in the day. At this point, the market is likely to find buyers underneath though, and I would say that is going to be the case closer to the ¥109.60 level, possibly even closer to the ¥109.40 level. I am looking for some type of bounce back due to a value based proposition, as we have exploded to the upside but may have gotten a bit ahead of ourselves in the short term. The Bears candle does in fact suggest that more profit-taking may come, but when you look at the explosive move to the upside that we have seen of the last week or so, it makes sense that we need to build up a bit of momentum.

If we were to turn around a break above the ¥110.33 level, then it would show that we are ready to continue the next leg higher. That opens up the door to the ¥111 level, where I see a lot of potential resistance based upon the gap that has been formed there. Breaking above that level then opens up the door to the 112.33 and level, which is the 100% Fibonacci retracement level. That of course is a longer-term outlook but one that I do believe will eventually come true.

Even if we do break down below there, it’s very likely that the market will find plenty of support based upon either the 50 day EMA which is pictured in red, or the 200 day EMA which is pictured in black. There is plenty of noise in that area to cause a bit of a bounce. Keep in mind that this pair is highly sensitive to the risk appetite around the world, so therefore it’s likely that the market will follow the overall stock markets in general. They are a bit stretched at this point, and a pull back over and those markets also makes quite a bit of sense. With that in mind, I believe that it is only a matter of time for the buyers return, so keep an eye on the daily candlestick and look for value on a bounce or at least a stable candlestick. I have no interest in shorting this pair, we have a long way to go before I believe the overall trend changes.