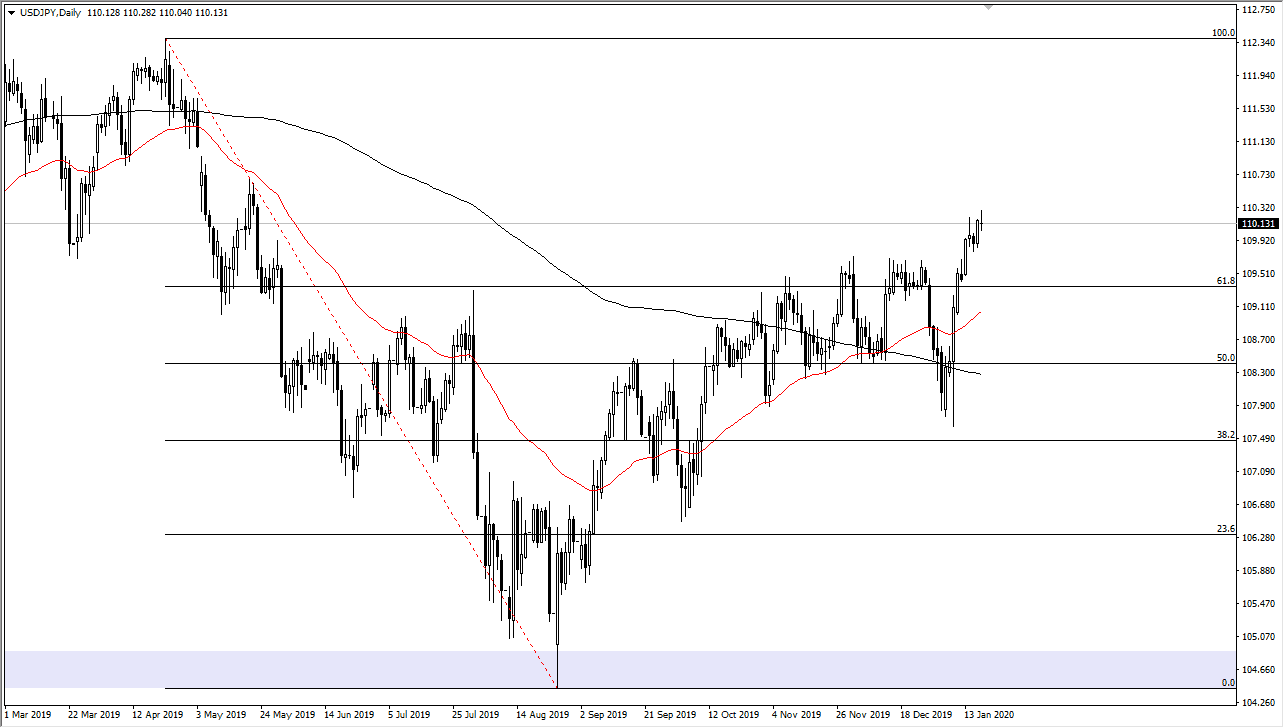

The US dollar went back and forth during the trading session on Friday as we had broken above the ¥110 level, but still are simply sitting around. At this point, I think that the market is running into a bit of exhaustion, perhaps needing to pull back a bit. The fact that we did up forming a bit of a shooting star suggests that the pullback is most certainly needed. If we do get that pull back, then I believe that the ¥109.60 level should offer significant support as it was previous resistance.

If we do break out to the upside, the market is likely to go looking towards the gap above near the ¥111 level. With this being the case, I think it’s only a matter of time before we get to that level, and then perhaps break above there to go looking towards the ¥112.33 level. Because of this, the market is likely to continue to see a push higher, but we may need to find momentum building pullbacks and at this point been so extended the way we are, it’s likely that a pullback will be welcomed by even the bullish traders.

Keep in mind that the USD/JPY pair is highly sensitive to risk appetite, so if the markets continue to look “happy” in general, as seen by risk appetite as far as stock markets are concerned and the like. Ultimately, the Japanese yen is considered to be a major “safety currency”, so it makes sense that it would lose value in a situation where people are willing to take advantage of shorting that currency. At this point, look for a pullback and then take advantage of it. However, if we do blow through the top of the shooting star that’s also a very bullish sign as well. After a move like this, markets will typically do one of two things, either pullback to find buyers underneath, or grind back and forth sideways simply killing time in order to build up momentum.

I have no interest in selling this pair, regardless of whether or not it is going to pull back in the short term. With that in mind I am simply looking for value, as most traders will be after the impulsive move that we have seen over the last several sessions. Ultimately, this is a market that looks like it’s destined to go much higher.