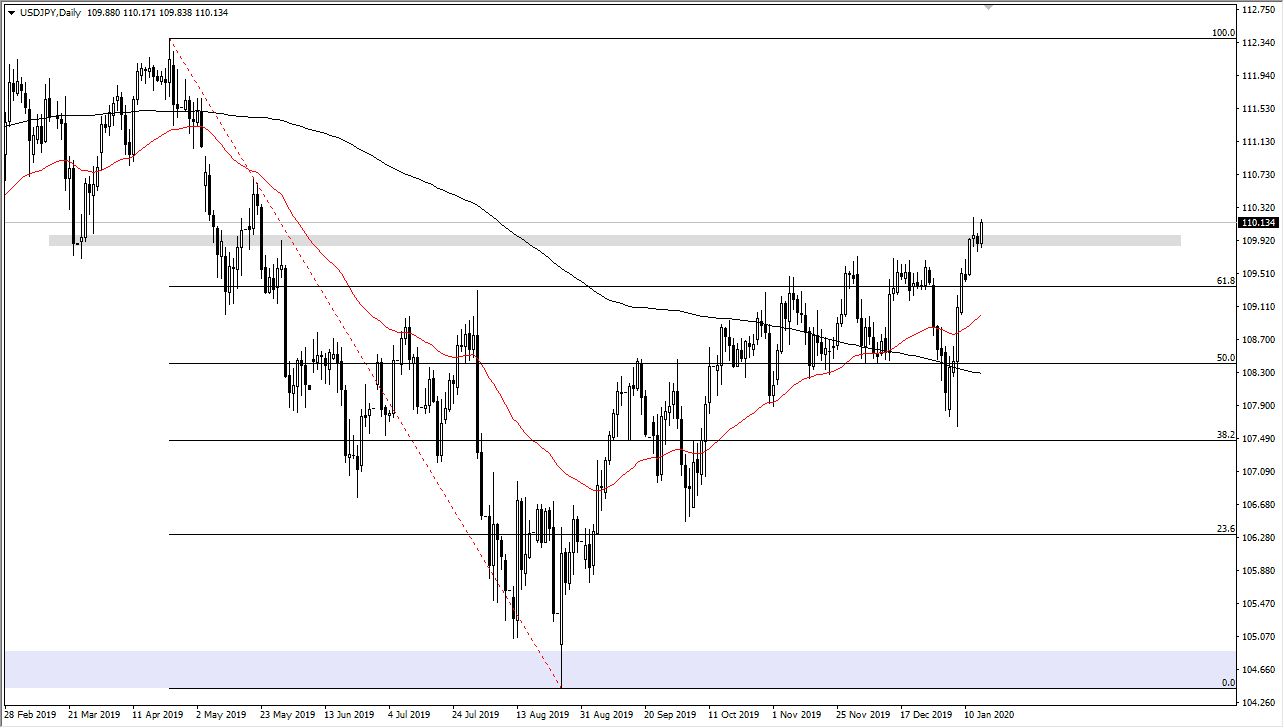

The US dollar has rallied quite nicely during the trading session on Thursday, breaking above the ¥110 level again. This is a market that is getting a bit extended, as we had shot straight up from the floor. However, the Thursday session started to see more buying, sending this market towards the top of the shooting star that had formed during the Tuesday session. If we can break above the top of the shooting star, I believe that more money will go flowing into this market and more of a “risk on” type of situation.

If that does happen, the market is very likely to go looking towards the ¥111 level, and then possibly than the ¥112.33 level. I do believe this happens eventually, but the question at this point is whether or not we can break above the resistance that we had seen earlier in the week. I think pullbacks at this point offer a buying opportunity, as the Japanese yen is clearly being shunned. Part of this will have been due to the United States and China signing that trade pact, but at the end of the day I think this has been coming for quite some time.

Pullback should have plenty of support near the ¥109.60 level, assuming that we even get one. If we don’t, then I expect quite a bit of short covering to come into play, pushing this market much higher. However, the real move might be in other pairs such as the AUD/JPY pair or even the NZD/JPY pair. Those market should move much quicker than this one, assuming that this is an “anti-yen” type of move.

If you see the US dollar start to lose strength against other currencies, and this pair arises, it means you should be buying one of those two currency pairs. Alternately, if you see this pair rallying but the US dollar rallying against several other currencies, then you should stay right here. Either way, I don’t see a scenario which a willing to sell this market anytime soon, so with that being the case I look at pullbacks as offering plenty of value that could be taken advantage of if you are patient enough and of course willing to build more of a core position than jumping in with both feet. That being said, I do expect a pretty strong move once we finally do break out to the upside.