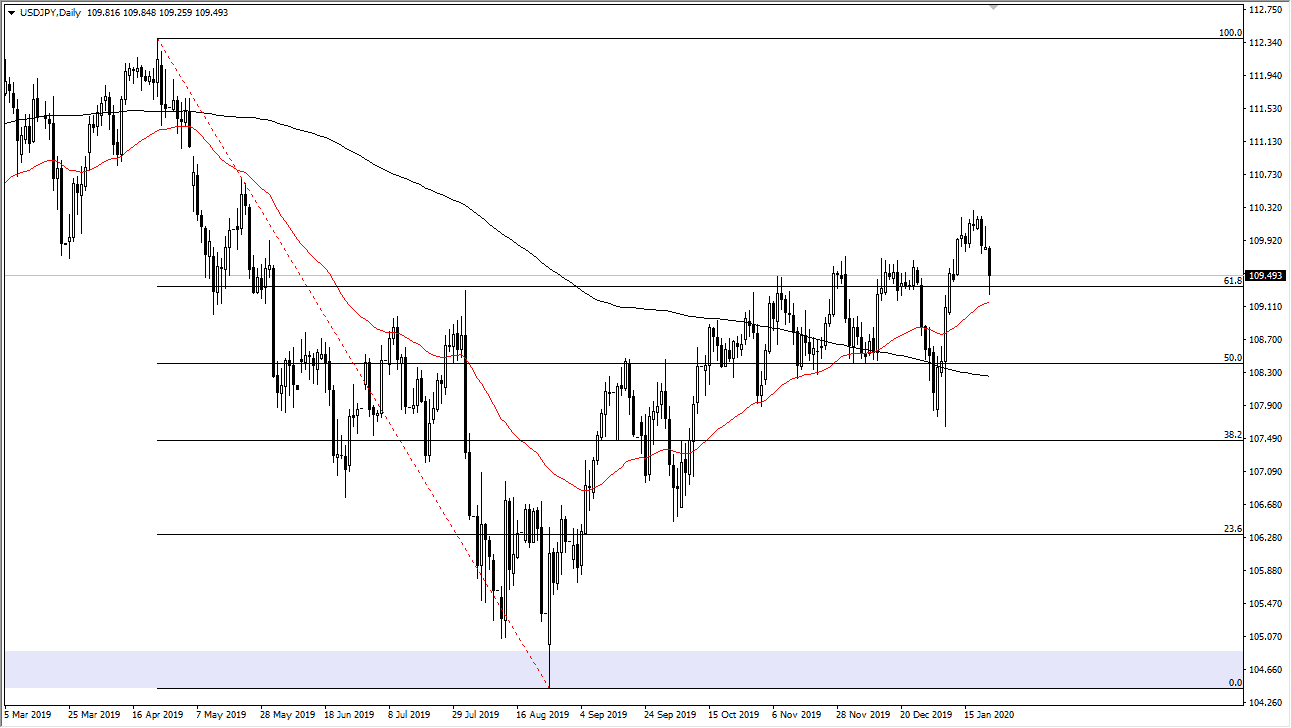

The US dollar has pulled back a bit during the trading session on Thursday against the Japanese yen, reaching down towards the 50 day EMA before bouncing. This is an area that I think should offer a buying opportunity, and it’s likely that we will go back towards the highs. The ¥111 level above could be the target as it is a gap above, and then after that the ¥112.33 level, as it is the 100% Fibonacci retracement level.

Even if we do break down below the 50 day EMA, the market is likely to go down towards the 200 day EMA next which is closer to the ¥108 level. All things being equal, this is a market that has been in an uptrend for quite some time, and it is in a bullish channel, so therefore it’s likely that the buyers will continue to jump in. In fact, we have seen buyers come back in right at the 50 day EMA and it’s likely that we will continue to see dips thought of as buying opportunities. After all, we have recently made a “higher high” on longer-term charts so it makes sense that we would continue to see buyers interested in this market.

The Japanese yen is considered to be a “safety currency”, and therefore if the markets get a bit nervous, the Japanese yen gets bought. Ultimately, if stock markets and other risk assets go higher, then it’s likely that the USD/JPY pair will continue to go higher. All things being equal, I think that there are plenty of value hunters out there when it comes to not only this pair but the stock markets, so I think that it should continue to coincide quite nicely. This doesn’t mean that it’s going to be easy to get to those levels above, but we eventually should. In fact, it’s not until we break down below the ¥108 level on a daily close where I would be looking to short this market, or perhaps even think about going to the downside. The recent pullback makes quite a bit of sense considering that the market had shot straight up in the air, and it can’t go in one direction forever. With this, it’s likely that the breather that was needed makes quite a bit of sense and therefore it’s likely that the value hunters will continue to take advantage of this opportunity.