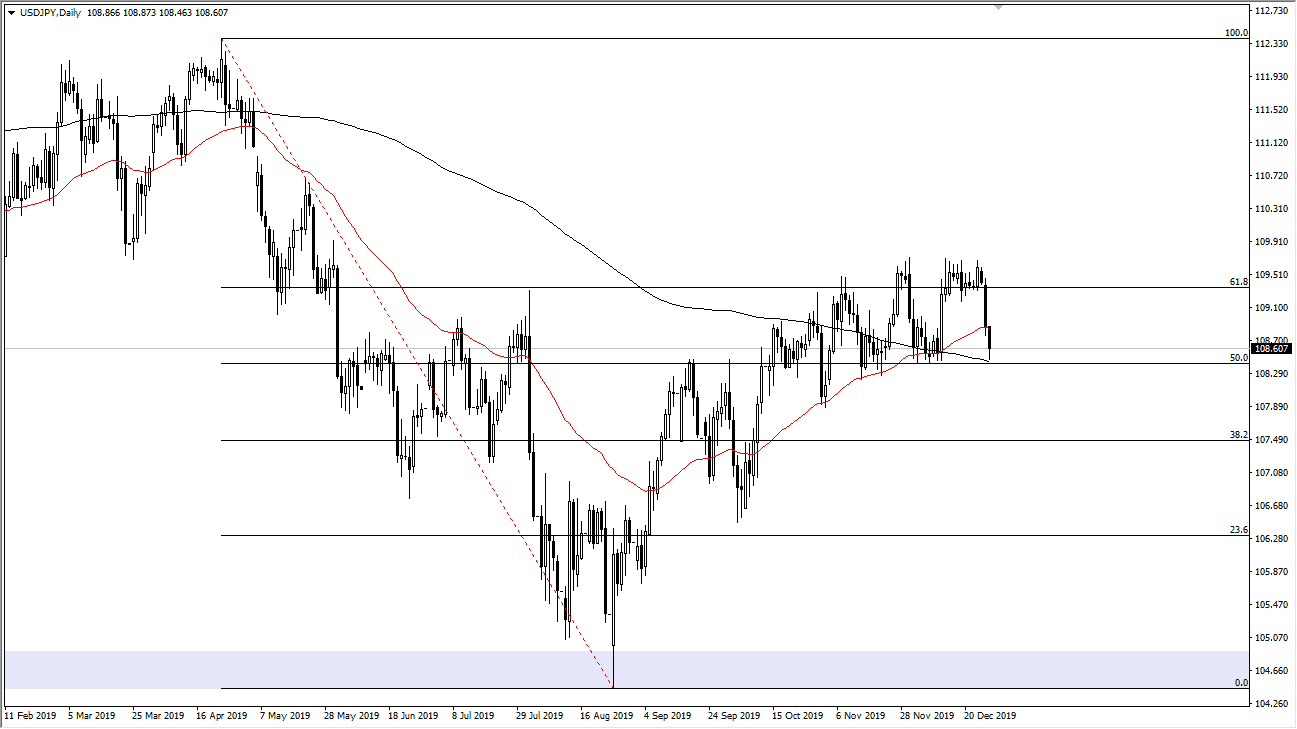

The US dollar fell again during trading on Tuesday, as we reached towards the 200 day EMA. By testing that area and showing signs of a bounce, it’s obvious that the market is going to continue to find a bit of support in that general vicinity. Beyond that, the ¥108.50 level continues offer a lot of support, and I do think that it is only a matter of time before we bounced enough to stay within the consolidation range that has been so important for so long. The ¥110 level above is the major resistance barrier that has yet to be broken, so getting above there of course will be difficult. If we can though, then the market is free to go much higher.

The pair has seen a lot of back and forth choppy in this area, and as we are just starting out the year, it will be interesting to see how the market behaves, but it clearly looks as if we are ready to stay in this range. Ultimately, we have seen a nice balance late in the day, but it’s hard to tell whether or not that was important as it was New Year’s Eve and a lot of traders will have been getting out of the marketplace.

That being said, if we do break down below the ¥108 level, it could break down below there and go looking towards the ¥107 level. I think that traders will continue to see support, but if we do break down like that it’s a good sign that there is more of a “risk off” type of situation. This is a market that looks as if it has been knocking on the door of ¥110 for some time, and one would have to think that eventually we could break out to the upside. Once we do, I would anticipate that the market would shoot straight up in the air towards the ¥111 level, and then eventually the ¥112.50 level which is roughly where the 100% Fibonacci retracement level sits. All things being equal, that’s what I expect but we need some type of good news to push this market to the upside. Because of this, I am bullish, but I am also somewhat cautiously optimistic when it comes to this pair. I recognize that we are sitting on major support, so if it does give way you would have to think about the next move.