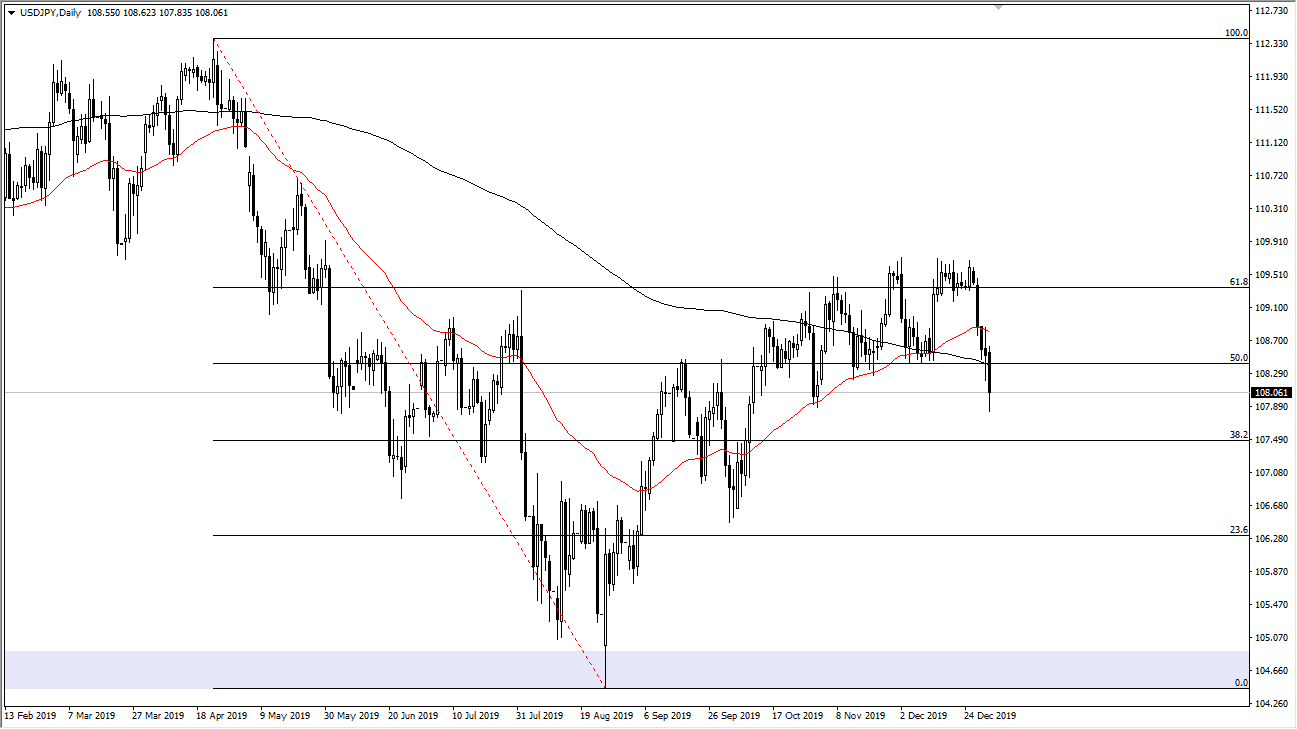

The US dollar has broken down significantly during the trading session on Friday, as the United States killed a major general in the Iranian Army. Because of this, there are a lot of concerns, but I also recognize that this major “risk off” move is probably a bit overdone. That being said, I’m not willing to step in and buy this and it’s not until we break above the Friday candlestick that I would be interested in trying to take advantage of any type of move to the upside. If we can wipe out the Friday session, it’s likely that the market will go looking towards the ¥109.60 level above. The ¥110 level above is essentially the gateway to much higher pricing.

To the downside, if we were to break down below the ¥108 level, it’s likely that we will then drop to the ¥107 level, possibly even the ¥106.50 level. This will more than likely only happen if there some type of escalation between the Americans and the Iranians, something that is still up in the air at the moment. It will be interesting to see how this plays out over the weekend, but at this point the Iranians have been complaining, but not really doing anything. As long as that’s the case the market will probably recover.

However, if there is some type of Iranian military action over the weekend, that would be very negative for the market and could send these pairs right back down. I believe that it is more than likely only a matter of time before you rally but it should be noted that this has been a very brutal move and there are a lot of questions out there still. I think that longer-term we are probably trying to get this market to break out to the upside and go looking towards the ¥111 level, and then eventually the 112.50 you level after that which is the 100% Fibonacci retracement level. However, we need some type of good news to make that happen, something that is in a bit of short supply at the moment. Expect a lot of volatility, but I still favor the upside, but will we need to see is a couple of days of stability before putting money to work. The market will continue to be noisy, but keep in mind that we have seen a massive bounce from extraordinarily low levels.