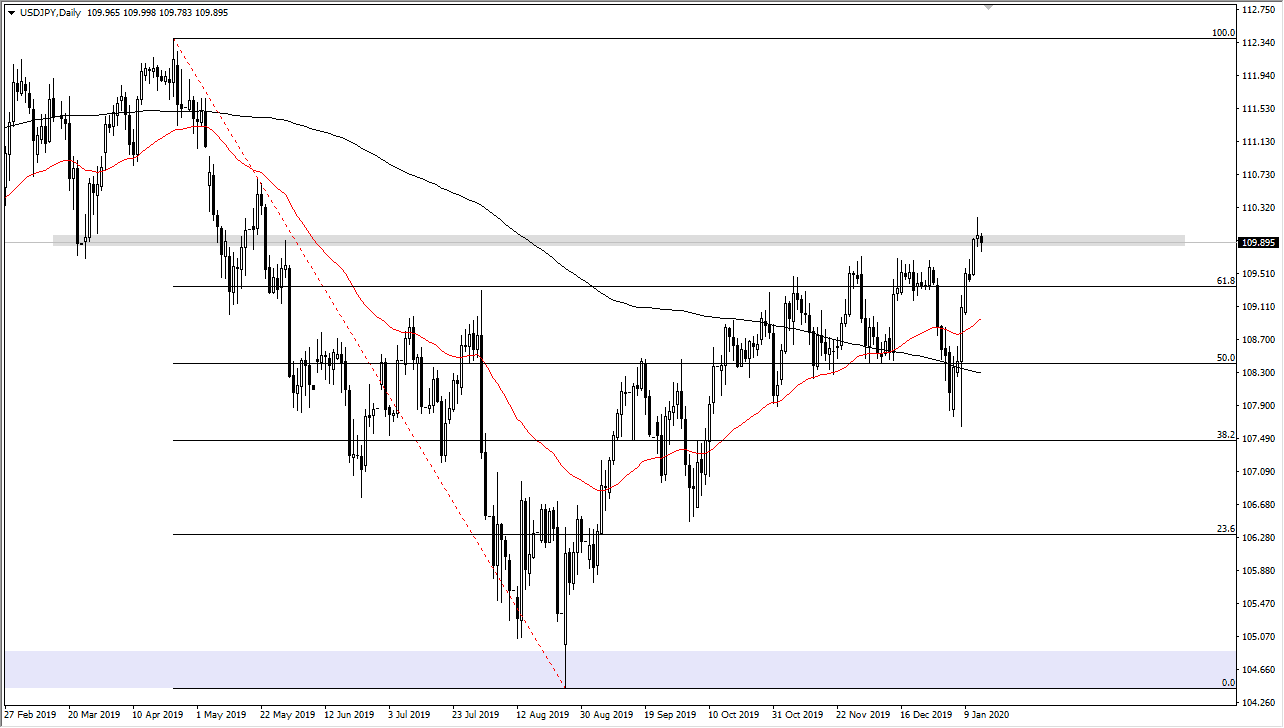

The US dollar fell a bit during the trading session on Wednesday against the Japanese yen but has recovered a bit to turn around and show signs of life again. I do believe that it’s only a matter of time before this market breaks out to the upside and breaking above the shooting star from the Tuesday session would be a sign to start going long. That would not only break through the area above the ¥110 level, but it would also wipe out anybody who shorted the market during the trading session on Tuesday. Ultimately, this is a market that I think eventually finds plenty of buyers and I also recognize that the ¥109.60 level is a bit of a short-term support level as well. Ultimately, I think that this is a significant move higher that simply needs to build up enough momentum. After all, the market can’t go straight up in the air forever.

If we do continue to go higher, I think that the ¥111 level is a significant area that you should be paying attention to due to the fact that there was a major gap there. If we can break above the gap, then I think that the ¥112.50 level is the next target. Alternately, if we do break down below the ¥109.60 level it’s likely that we will then go down to the 50 day EMA, painted in red on the chart. Furthermore, the market could then go down to the 200 day EMA but I think it would be a major shift in attitude.

At this point, I think that the market is little overextended, but I certainly believe that the major bounce that we have seen suggests that we have plenty of buyers at this point there willing to step in and take advantage of an overall “risk on” attitude. Furthermore, I believe that we will eventually have a reason to go higher but pay attention to the stock markets as they can give you an idea as to what the risk appetite is in general. This is especially true with the S&P 500 so I tend to look at this chart and that one for some type of correlation as one will quite often confirm a move in the other. At this point, dips continue to offer value, and I think that most of the trading world right now looks at it as such.