USD/JPY: Bank of Japan’s policy release had little impact

Yesterday’s signals were not triggered, as none of the key levels have been reached yet.

Today’s USD/JPY Signals

Risk 0.75%.

Trades must be taken from 8am New York time Tuesday to 5pm Tokyo time Wednesday.

Short Trade Ideas

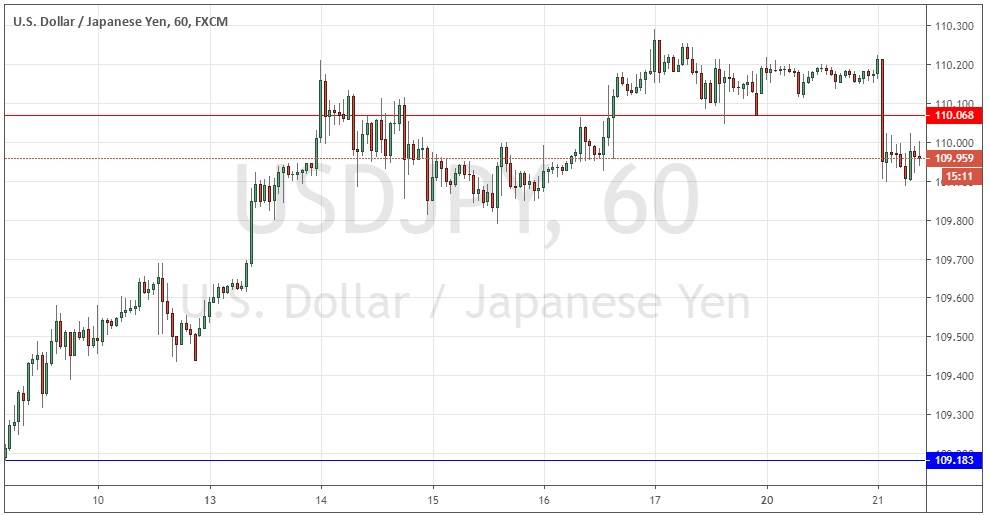

Short entry following a bearish price action reversal on the H1 time frame immediately upon the next touch of 110.07 or 110.69.

Place the stop loss 1 pip above the local swing high.

Adjust the stop loss to break even once the trade is 20 pips in profit.

Take off 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to run.

Long Trade Ideas

Long entry following a bullish price action reversal on the H1 time frame immediately upon the next touch of 109.18 or 109.00.

Place the stop loss 1 pip below the local swing low.

Adjust the stop loss to break even once the trade is 20 pips in profit.

Take off 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to run.

The best method to identify a classic “price action reversal” is for an hourly candle to close, such as a pin bar, a doji, an outside or even just an engulfing candle with a higher close. You can exploit these levels or zones by watching the price action that occurs at the given levels.

USD/JPY Analysis

I wrote yesterday that the odds were still in favour of the bulls overall but watch out for a sudden bearish breakdown to a price below 110.00 on much stronger volatility – this would signify the start of a retracement which could go as low as 109.18.

I was right to watch out for this breakdown, although it seems so far that the volatility is not significantly higher than it has been. Anyway, following the Bank of Japan’s policy release earlier, the price has broken down below 110.07 and this level and general area now seems to have become resistance. Usually, there would be a good chance that the price would recover and move higher, but volatility has generally been so small, it does not feel like we will see a recovery now. Therefore, a bearish move down to 109.18 is looking more likely now. Much may now depend upon how the U.S. stock market behaves when New York opens today. If stocks go up again, we may see the price get back above 110.07.

I would be prepared to take a short trade from a bearish reversal following another touch of 110.07. Another factor making me bearish is the way that we are seeing the tops of recent candlesticks rejecting the round number at 110.00 very clearly. There is nothing of high importance due today concerning either the JPY or the USD.

There is nothing of high importance due today concerning either the JPY or the USD.