The struggle of safe heavens appears evident in the performance of the USD/JPY pair, but ultimately the Japanese yen prevails, as the pair retreated to the 108.72 support, the lowest level for more than two weeks, which supported the yen's gains as a stronger safe haven. Global fears of the rapid spread of the deadly Corona virus, which paralyzes the global economy after it has passed somewhat the global trade war between the two largest economies in the world, even if temporarily.

China has intensified its comprehensive efforts to contain the Coronavirus, and has extended the Lunar New Year holiday to keep people at home for as long as possible to avoid spreading the infection with the death toll rising to 81. In a new development, Mongolia has closed its vast borders with China, and Hong Kong and Malaysia have announced that they will prevent Visitors from the Chinese province after a warning from medical officials that the virus's ability to spread is increasing. Travel agencies have been ordered to cancel group tours across the country, adding to economic losses.

Stock markets around the world fell sharply as the closure of Chinese cities was expected to stifle travel, shopping and business for millions of people. Although markets in most parts of Asia, including China, were closed for the new lunar year, they fell by more than 2% in Japan and across Europe. Wall Street was expected to drop at the opening, and crude prices fell 4%.

And China's massive containment efforts have started to suspend flights, planes and buses from January 22 to Wuhan, the city of 11 million people in central China, where the virus was first detected last month. The ban has spread to 17 cities with more than 50 million people in the most severe disease control measures ever.

On the economic level. New US home sales fell 0.4% in December, and fell slightly after higher mortgage rates supported strong gains for 2019. The US Department of Commerce announced that new homes were sold at an annual rate of 694,000 homes last month. But for 2019, sales increased 10.3% to 681,000, the highest total sales since 2007 when 776,000 new homes were sold, as the housing bubble started to contract before the Great Recession.

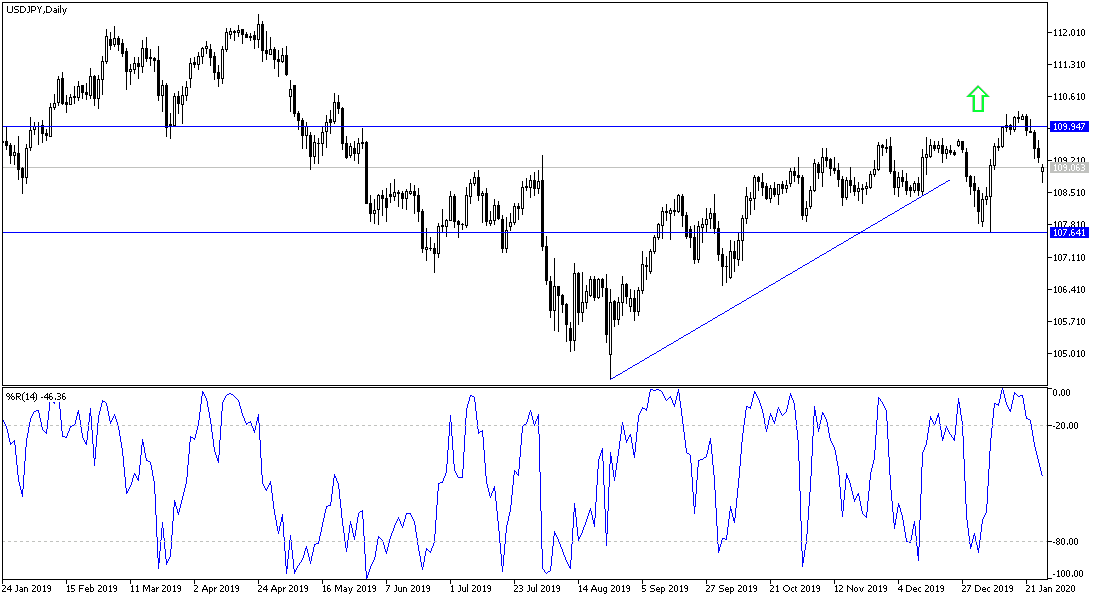

According to the technical analysis of the pair: the general trend of the USD/JPY pair has turned downward since it passed the 110.00 psychological resistance and the pair is vulnerable to a move towards 108.00 psychological support and beyond in the event that the global concern increased from the consequences of the global corona pandemic, which threatens economic growth Global. Technical indicators have reached oversold areas, but the pressure remains. The Japanese yen is a safe haven of choice for investors in times of uncertainty and the current situation is appropriate. Positive US data today may push the pair to make gains and thus an opportunity to resume selling.

As for the economic calendar data today: From Japan, the Producer Price Index and Consumer Price Index issued by the Japanese Central Bank will be announced. During the US session, the most important items will be the Durable Goods Orders, the US Consumer Confidence and the Richmond Industrial Index.