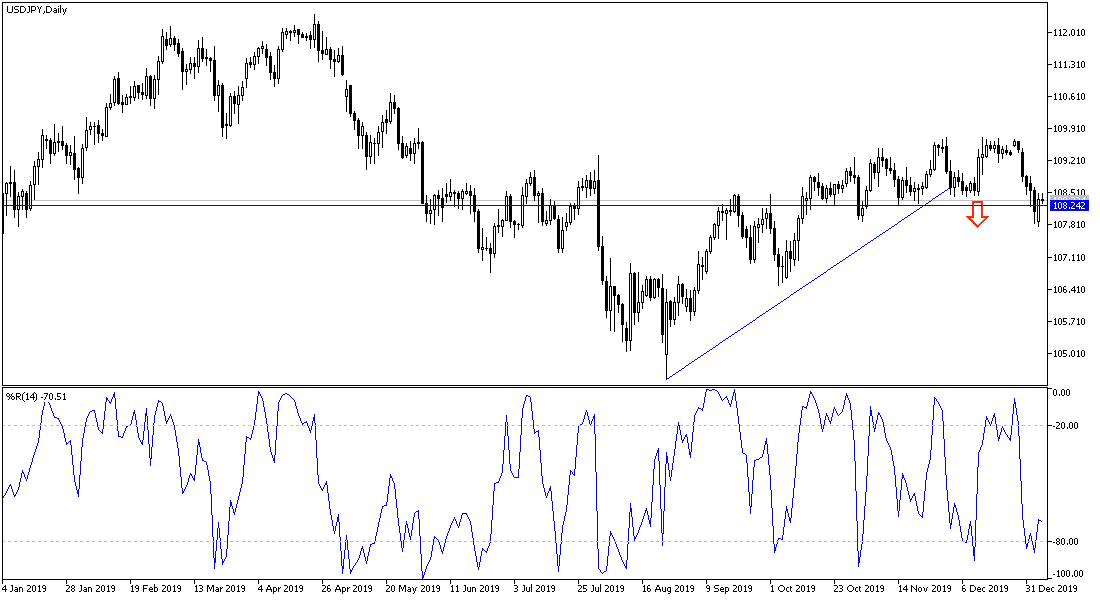

Tensions are renewed in the Middle East, with the threatening language between Iran and the United States of America, after the latter assassinated a prominent Iranian military commander, Qasim Soleimani, and his companions. The situation to strong investor appetite for safe havens, most notably of which is the Japanese yen, with negative interest, and was recently joined by the US dollar. This brought instability to the price of the USD/JPY pair. With the beginning of trading this week, the pair fell to the 107.76 support, and after that, the correction came back up towards the 108.50 level, which is where the price is stable at the time of writing. The pair is in a wait-and-see mode for cautious anticipation of developments on the ground between the United States and Iran. Since Soleimani’s death, the matter does not exceed the threat statements between them, and the most prominent ones, Trump's tweets via Twitter on Saturday, in which he said that Washington has chosen 52 locations inside Iran that will be targeted in the event of more attacks on American interests in the region.

Financial markets did not celebrate much for the upcoming signing of the trade agreement between the United States of, which shook confidence in the markets throughout the months of the tariff war between them. This agreement is tentative and there will be stages to come. After signing on January 15, Trump will travel to China to agree on these stages and the possibility of accelerating them. Trump wants to return to confidence in the country's economic performance, in the stock markets and in the American consumer confidence, ahead of the US presidential elections this year.

The South China Morning Post reported that a Chinese delegation will already arrive in the United States next week. However, officials were surprised that the Trump administration unilaterally announced a formal signing ceremony on January 15 and that the matter would be ended even if the Chinese president did not attend.

For economic news. Chinese Caixin PMI reading and composite PMI fell for December. Caixin fell to 52.5 from 53.5, the highest in seven months. The composite index fell to 52.6 from 53.2. The November reading was the highest since early 2018.

According to the technical analysis of the pair: the general trend of the USD/JPY pair is still downward and at the present time, there is a struggle for safe havens, but increased tensions will eventually be in the interest of the Japanese yen and any return to the pair below 108.00 psychological support will give the decline a strong momentum. There will be no upward correction opportunity without the pair moving towards 110.00 psychological resistance. The closest support levels for the pair are currently at 108.10, 107.70 and 106.90 respectively. I still prefer buying the pair from every downtrend.

As for economic calendar data: the focus will be on US data announcement, Trade Balance, ISM PMI, and US Factory Orders.