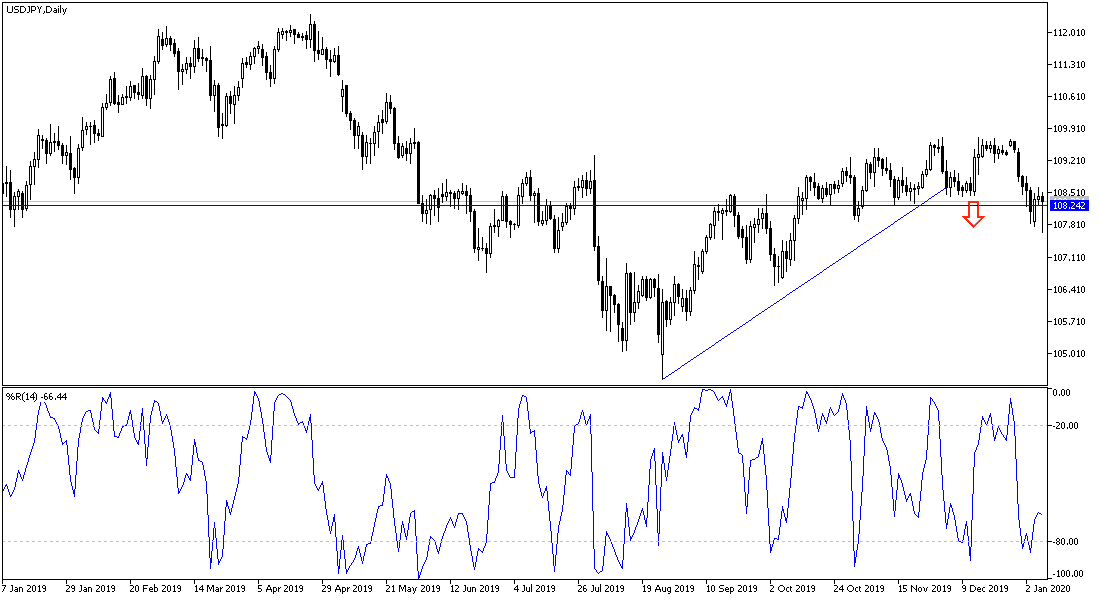

In the beginning of this week’s trading, the USD/JPY pair plunged to the 107.76 support, and we had previously recommended a purchase level in our free recommendations around the 107.70 support, and after that the pair set out to correct up to the108.62 level at the time of writing. The pair's performance remains temporarily stable, until the Iranian retaliation for the killing of Qassem Soleimani and his companions in a targeted air strike. There is a balance in the pair’s performance, because the two currencies are safe havens and the victory will surely be for the Japanese yen with negative interest.

On the economic level. A survey by the Institute of Supply Management (ISM) indicated that US service sector production increased at the end of the year, which weakened fears of an imminent slowdown in the world's largest economy. The ISM non-manufacturing PMI rose from a reading of 53.9 to a reading of 55.0 for the month of December and expectations were for an increase of only 54.5, although the gains were mainly due to an increase in the current activity index, all other sub-indices remained stable or retreating earlier.

The sub-employment index of ISM decreased by 0.3% in December while the new orders index decreased by 2.2% and the price scale has not changed. The job numbers follow a similar decline in employment within the manufacturing sector, which was revealed last week by the ISM survey of industrial companies.

Employment metrics in ISM service and manufacturing surveys provide economists with early, reliable guidance on the likely pace of macroeconomic job growth per month.

The ISM survey, which was announced yesterday, indicates salary growth of about 180 thousand, but expectations indicate an increase of 150 thousand new jobs only. The non-farm payrolls report will be released in the United States at 13:30 on Friday, and its actual numbers either confirm expectations among some investors that the economy slowed in the last quarter of 2019, or completely undermine it.

According to the technical analysis of the pair: The general trend of the USD/JPY pair is currently in a neutral mode with a stronger downward bias, especially if the pair moves towards the 108.00 psychological support and breaks down. On the upside, as we expected before and confirm now, the 110.00 psychological resistance is still the key to the strength of the upward reversal. Middle East tensions between the United States and Iran, and the details of the trade deal with China, will be the most prominent drivers of the pair in the coming period.

As for the economic calendar data: From Japan, average wages and Japanese household confidence will be announced. Then, the ADP Survey of change in the NFP numbers from the U.S.