For three consecutive trading sessions, the USD/JPY price is stable around the 110.00 psychological resistance in a wait-and-see mode until more momentum is obtained to confirm the strength of the bullish correction. Recent gains stopped at the 110.21 resistance, the highest in seven months. The dollar is on an important date today with the release of retail sales figures for December 2019. The recent gains were supported by risk appetite and the abandonment of the Japanese yen as a private safe haven, with the formal signing of the Phase 1 trade agreement between the United States and China at a special ceremony held at the White House, where President Trump sees the agreement as a victory for his economic policy while he is trying He gained the confidence of the Americans ahead of the presidential elections next November.

Under the agreement, the United States dropped plans to impose more tariffs on an additional $160 billion of Chinese imports. The move, which was scheduled for December 15, 2019, would extend the tariff to include everything that China ships to the United States. The United States also cut existing tariffs in half, to 7.5%, however, the United States maintains a tariff on Chinese imports of $360 billion, or nearly two-thirds of the total, to press Beijing to abide by the terms of the agreement.

In return, China will increase its purchases of agricultural and other products by nearly 200 billion dollars this year and next. China has vowed to stop forcing the American and other foreign companies to deliver technology so that they can enter the Chinese market. The deal also requires China to take effective and prompt measures to erase sites that sell pirated goods. The agreement facilitates the filing of criminal cases in China against those accused of stealing trade secrets.

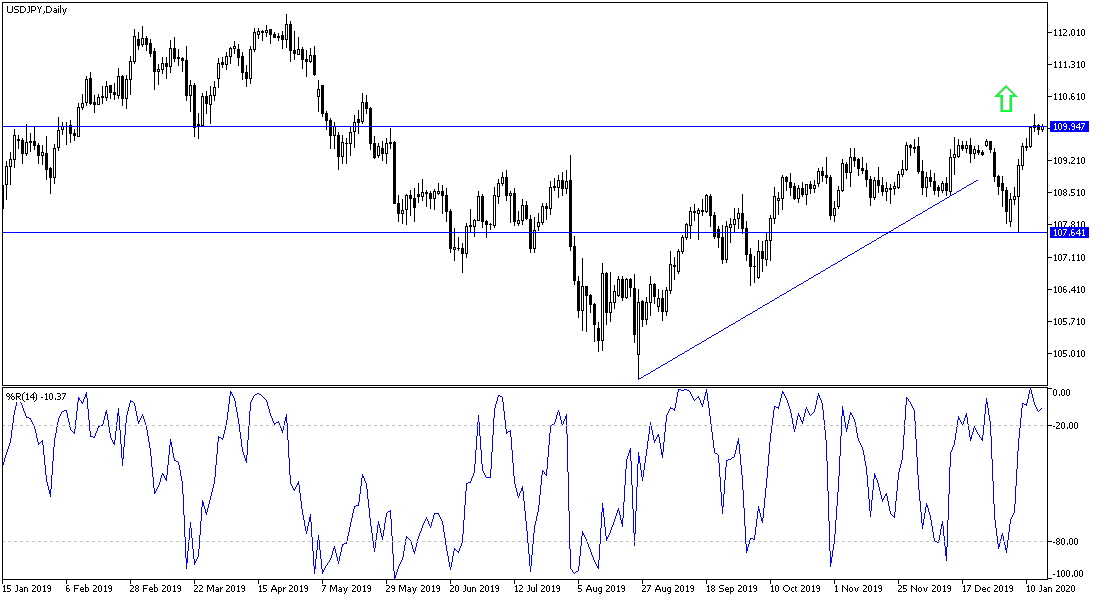

According to the technical analysis of the pair: So far the terms of the first stage agreement support investors’ optimism, consequently increase the USD/JPY gains. This will depend at the same time on the improvement of the upcoming data results, and in that case, we will notice a more rise for the pair towards the resistance levels at 110.35, 111.00 and 111.55 respectively. There will be no new bearish control over the performance without the pair heading towards 109.00 support. I still prefer buying the pair from every downtrend.

As for the economic calendar data: The focus will be more on the US data, retail sales, the Philadelphia industrial index, and jobless claims.